Below is a revised and expanded translation of “Umverteilung oder Handelskrieg?” from issue #104 (Winter 2019/2020) of the German magazine Wildcat—part 3 of their series on trends and struggles in China since 2018. (The English version of part 2 was published here as “Winter is Coming.”) This third portion goes into more analytical depth regarding the trade war in particular and its background over the past two decades, arguing that the previous model of growth has reached an end without any clear alternative in sight. While we broadly agree with the thrust of this piece, we hope to clarify our position on some of the points it raises in future blog posts and journal issues.

For the past couple of years, I’ve been working at an IT company in mainland China. I originally moved from Europe to China in the hope of better understanding the historical changes here and for the global economy since China joined the WTO nearly two decades ago. As a foreigner here, I’m often asked, “Which is better, China or the West?” Apart from responding in jest that “the West” is not what it pretends to be, I don’t find this question easy to answer. In short, I don’t have a very positive opinion of either place. Wherever I go, the living and working conditions of most people are unnecessarily hard and unhealthy, and the social order and politics serve not the needs of the population but the control and exploitation of the many. Although I’m neither an academic nor a theoretician, in order to digest my own experience from different places, I often reach out for theoretical concepts to grasp the commonality hidden beneath the layers of different cultures and politics.

Looking from my own everyday experience and my perspective on societies and political matters, I’m naturally very concerned with the ongoing trade war between the US and China, a development which looks like growing animosity between “East” and “West.” That’s why I feel the urge to get my head around these developments. I dug through various articles, books and statistics and engaged my friends in many discussions. The result is a work in progress which I want to share with a wider audience to further the debate. In a nutshell, I think we need to develop an internationalist perspective on the trade war—along with the protectionism and nationalism that orchestrates it. I think we can achieve this when we turn around the common view on the trade war and economic slowdown in mainland China: it is not the tariffs that have caused the slowdown, but the slowdown and the expiration of China’s growth model that have pushed the government adopt a more assertive, repressive and nationalistic approach. What puts the most pressure on the government in Beijing is not Trump and US tariffs but the growing expectations of the working population. The underlying root cause is the worsening crisis of over-accumulation shared by the US, China and many other countries.

In January 2018, the US government imposed the first import duties on a number of Chinese goods, including washing machines and solar panels, which evolved into a tit-for-tat escalation of tariffs applied by Washington and Beijing, punctuated by transient “truces” for negotiations. The tariff war, however, has involved not only tensions between the US and China escalating into conflicts over technology, investigations of US-based Chinese researchers and intensified scrutiny of overseas Chinese living in the US, but even the realms of culture and sports. Now, there is also a budding currency war (in which the ECB is also playing a major role, with negative interest rates pushing down the euro). The depreciation of the RMB by 10 percent since the outbreak of the trade war is an attack on real wages of Chinese workers, and a direct transfer of income from Chinese consumers to the export industry, where consumers experience declining purchasing power, and exporting businesses gain sales of their goods through cheaper prices.

In the global crisis 2008/9, “Chimerica” or the symbiotic relationship between China and the US ended: China had sold manufacturing goods to the US and hoarded US dollars which were invested in US government bonds. This supported low interest rates and a real estate boom and enabled US consumers to buy even more Chinese goods. After the crisis, Obama promoted containment through free trade agreements like the Transatlantic Trade and Investment Partnership (TTIP) with Europe, and the Trans-Pacific Partnership (TPP) around the Pacific rim, both excluding China. After both trade deals failed, Trump is now focusing on a confrontational approach to China, and is resorting to bilateral negotiations, rather than large, multilateral trade deals, as well as tariffs to put pressure on China (and to some extent on Europe). Confronting China, and slapping tariffs on foreign goods, also helps convince his electorate in US rustbelt communities and rural agricultural regions that he would win better conditions for them.

But the goals of US policy on China have not fundamentally changed under Trump, and the military strategy in the Pacific remains essentially the same. Whether this is intended to produce decoupling from China and thwarting of this rival nation’s economic development, or whether it is about greater profit sharing in this development, depends on the course of the conflict. In any case, the strategy of neglecting the World Trade Organization (WTO) and relying on one’s own weight as a consumer market in bilateral negotiations is not new: even before Trump – specifically between 2000 and 2016 – bilateral trade agreements quadrupled, while the WTO was effectively rendered useless, in no small part due to US non-compliance. Trump’s protectionism is supposed to be a means of enforcing improved market access to China for foreign companies and free trade in the global economy, but it may end up causing continued protectionism and declining world trade.

By introduction of tariffs and restrictions against Chinese companies, like the ban on communications giant Huawei, the USA is acting as an aggressor. However, up until last year, the Chinese government has always been willing to compromise, yield or hold out and make promises. The central questions, which I pose myself and which will guide me through this article is therefore: Why did Beijing stop to give in? Why did Beijing not avoid the escalation at this time in particular?

To understand this change of strategy, I think we need to take a closer look at the economic developments and particularly look at how wages (and wage increases) have been paid for in China so far. After all, economic and trade policy are fundamentally determined by this dynamic. Governments – whether autocratic, democratic or whatever – draw their resources and power from the amount of surplus labour which they can tax or otherwise appropriate. The Marxist concept of surplus labour describes basically the amount of labour one can do beyond what one needs to sustains one’s own life. A capitalist company appropriates this as profit, the state uses taxes and other means to takes his share of the surplus labour. In a state-socialist country with a significant share of publicly owned companies and means of production, the appropriation of surplus labour might not be called profit and other means beyond taxes are used by the government to secure its share. No matter how you name or implement it, the state’s military, welfare, research etc. spending power originates from and is limited by the appropriation of surplus labour. All states are therefore bound to squeeze the (more or less sustainable) maximum of surplus labour out of its own and other countries’ working population. Certain policies can deviate from this objection, but only for a limited time and scale. Policies are not directly determined by economics, but cannot ignore economic realities for a longer period of time.

Since this understanding of states and the relationship between politics and economics is common to all forms of states, I find it very useful when looking at things – not only – in China.

China’s Economic Model: Investment not Consumption

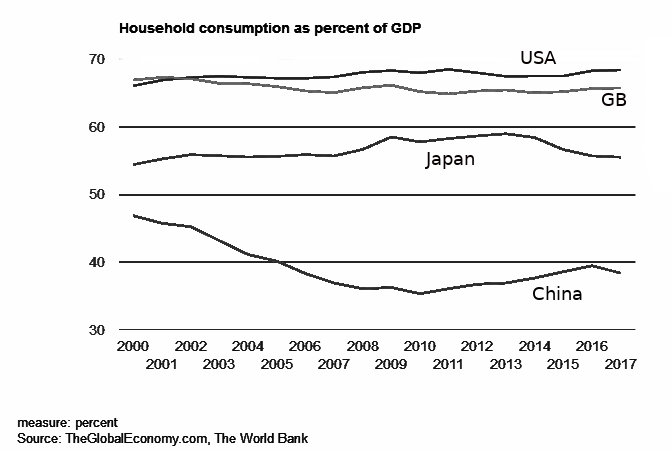

China’s growth model has been based on high investment rates since the end of the Mao era. With the “reform and opening” of the economy, officially announced by Deng Xiaoping in December 1978, investment as a share of GDP grew dramatically from the early 1980s onwards. Since China’s WTO accession in 2001, and the rapidly rising export surplus, by 2008, China’s investment as a share of GDP rose to almost 45 percent! In comparison India’s share of investment is around 30 percent, Germany’s is at around 22 percent. At the same time, the share of private consumption in GDP fell. GDP is calculated as the sum of consumption, investment and capital imports and exports. If export surpluses and high levels of investment occur simultaneously, the share of consumption must be extraordinarily low, and this is indeed the case in China. Until the end of the 1980s, the share of private consumption was just over 50 percent, but in the 1990s it fell below that. From the year 2000 on, it fell particularly rapidly, reaching 34 percent in 2010 after the onset of the global financial crisis. Such a low share of consumption is regarded by many analysts as historically unique.1

The following chart shows that the share of private consumption in Japan, the UK and the US has remained roughly the same over the past twenty years, India’s private consumption moved between 57 and 60 percent of GDP; in China it was already much lower than these economies in 2000 – and has fallen even further since then. (How people in Japan, the US and the UK were able to maintain their consumption standards while facing declining real wages is another question: multiple jobs, private debt…)

The high level of investment, especially state investment, was thus financed by the very low share of wages in the overall economic output. During the export boom and the growing export surpluses, the Chinese central bank bought up the dollars earned by domestic exporters with yuan (RMB). This rapidly growing money supply was used to finance the increasing investments. Normally, a rapidly growing money supply leads to devaluation of a country’s currency. But thanks to the high export surplus, the central bank had a lot of leeway and, conversely, had to weaken the appreciation of the RMB by rapidly increasing the money supply. So money printing had two advantages: it financed the investment boom and it helped exports through a lower valuation of the RMB. This was, of course, paid for by Chinese workers, whose share of the growing economic wealth shrank steadily, while individual incomes and private consumption have risen in absolute terms since the 1980s. For example, factory wages for migrant workers rose by about 5 percent annually2 between 2000 and 2009 – but nominal GDP rose by almost 19 percent, almost four times as fast.

The state set the framework for this gigantic redistribution primarily through measures in three areas: wage repression, compulsory savings at low interest rates and subsidies.

(1) With the layoffs at the state owned enterprises, welfare benefits were lost, social wages fell, and the burden of old-age provision and health care were shifted on to workers. Wages in the industrial centers were kept low by absorbing excess labor from the country’s baby-boomer generations of the Mao era, also known as “the demographic dividend.” The reproduction costs of these migrant workers were reduced by the hukou (household registration) system, which excludes rural residents from social benefits like healthcare, education or housing rights in the urban centers where they live and work; still about 50 million workers’ children grow up not in the cities where their parents work and live, but in the (cheaper) countryside with their grandparents. In addition, independent trade unions and other organisations have been banned since the 1950s.

(2) Even during the boom years with double-digit growth rates, (savings) interest rates were significantly lower than growth and profit rates. Small investors, and in particular wage earners, who have to save money for sickness, housing purchases, their childrens’ education and old-age provisions (savings rate in China 30 percent, in Germany 10 percent), have lost considerable sums to borrowers, i.e. companies and the state.

(3) The provision of relatively cheap land and even lower compensation for former peasants have been an important form of subsidies to business, who buy up cheap land for development. Finally, allowing the environmental degradation and pollution of proletarian living spaces is also a form of state subsidy to enterprises.

Crisis in 2008

With the collapse of exports, the growth model entered its first deep crisis, as investments could no longer be financed with export surpluses. The American half of Chimerica was closer to the heart of the crisis. At first it looked as if China, by contrast, still had plenty of room for maneuver in this situation: in 2009, huge debt-financed infrastructure programmes were launched, together accounting for almost a third of GDP – one of the largest crisis rescue programmes in history, without which the global economy would not have come out of the hole so quickly. Between 2009 and 2014, investment as a share of GDP therefore rose even further to 48 percent. During this period, China used more concrete in three years than the USA had during the entire twentieth century.

The lowest point of private consumption as a percentage of GDP occurred in the year 2010, the year in which a large wave of strikes broke out after two years of wage stagnation (starting at the Honda transmission plant in Guangdong). Strikes, rising demand for labour in the booming construction industry and higher minimum wages mean that the share of private consumption in GDP rose from around 34 to 39 percent between 2010 and 2015/2016. The wage gains of migrant workers since 2010 were also reflected in the ratio of wages to GDP growth rate. Between 2011 and 2014, wages grew at 9.5 percent per year above the nominal GDP growth of 8.2.3 For the longer period between 2005 and 2016 the picture is as follows: GDP almost quintupled, factory wages almost tripled; GDP grew annually by 15.5 percent, while wages grew by 10.4 percent.4

Initially, both growing profits and (slower) rising wages were paid for with export surpluses. Since the crisis of 2008/9, this was initially kept going by growing debt. Total debt rose from 158 to 282 percent of GDP between 2007 and 2014, so for each percentage point of growth, debt rose by more than two percentage points. But it was precisely during this phase that workers were able to fight for wage increases above GDP growth. Therefore, the debt-financed growth could not be sustained. In Guangdong, for example, after the 2010 strike wave, some experimentation with company unions, company elections and wage negotiations were allowed to take place. But that only lasted for a few years. Since China’s stock market crisis of 2015, the government has been mixing strategies, by lowering debt levels, continuing some debt driven economic development, combined with repression. It is taking an increasingly heavy handed approach against labour NGOs, and the demands for wage increases, or the payment of wage arrears.

Stock Market Crisis 2015

Liberalization of the financial sector was promoted in 2013 in order to raise money to sustain the investment driven economic development; as a result, there was a brief equity boom with price gains of over 100 per cent. This imploded in the summer of 2015, causing among other things a flight of capital, and foreign exchange reserves melted by around $900 billion. Since 2016, the Chinese government has ended its efforts to internationalize the RMB and tightened capital controls again.

The stock market crisis of 2015 marks a dramatic turning point, where the relative growth of the consumption and wages as a share of GDP has stopped – despite government propaganda to the contrary, no actual re-balancing towards the domestic consumer market has happened since then! The anti-corruption campaign launched under Xi has forced party bureaucrats to be more cautious about business, and growth in state investment is declining. The government is trying to sell the slowing investments as deleveraging; in reality, debt as a percentage of GDP continues to grow, although more slowly.

Moreover, the debt of “private households” is accelerating. It rose from 39 to 49 percent of GDP between 2015 and 2017 and reached 55 percent in the summer of 2019. This seems low compared to the US, where private debt stands at 76 percent of GDP. If, however, private debt is compared to average disposable income, a more relevant comparison than with GDP, current debt levels of private households are around 126 percent of their income (for the USA this ratio is 98 percent).

Since autumn 2018, the slowdown in economic growth has been met with expanding infrastructure investment and increasing new borrowings. Total debt level is between 300 and 315 per cent of GDP, depending on the calculation, and the Bank of International Settlements expects an increase of seven to eight percentage points in 2019.5

Although (predominantly private) corporate insolvencies are on the rise, most loans are rolled over when they mature. All this goes on against the backdrop of a shaky banking system. In the course of the restructuring of bad loans, interesting details became public. Chinese banks, for example, sold off more bad loans in 2018 alone than they had previously listed in their books! Nobody knows the extent of bad loans still hidden in banks’ books.

The situation today

The statistics about China’s economic development appear more accurate than they are. There are obvious inconsistencies and they are highly political and thus less reliable, however, they clearly show that the absolute and especially the relative share of consumption in China is still very low and has been stagnating for years – despite all propagandist talk of strengthening the domestic market.

In this part, I want to discuss a range of social, political and economic topics in China like private consumption, public investment, labour relation, militarisation and more which are or are not changing. Some of these developments are obviously related to the trade war like industrial policy and military, others like authoritarian management and low consumption levels are indirectly related to the trade war but since I consider the expiration of China’s economic growth model as the root cause for its foreign and military policies, labour relations are at the heart of what I think we need to look at.

* The share of consumption stagnates at 39 percent, about 29 percentage points lower than in the USA (68 percent, according to the Federal Reserve of St. Louis). In absolute terms, private consumption at the end of 2018 was 19,853 RMB (or about $2,971) compared with GDP per capita of 64,644 RMB ($9,675). By comparison, at the end of 2018 the US had a GDP of around $57,170 per capita and private consumption of $42,415 per capita (i.e. a share of 74 per cent, the deviation from the aforementioned 68 percent being due to different methods of calculation). While China’s GDP per capita has thus reached about 17 percent of the US level, private consumption per capita is only 7 percent. Germany is also financing its export surpluses through a relatively low share of private consumption in GDP, which fell from 58 percent to 52 percent between 2007 and 2018.6

After a slight decline in inequality in China after the crisis, it has increased again in recent years. The Gini index reached 0.5 in 2018, on a par with Brazil and Colombia.7 Rising inequality again puts pressure on consumption, with the rich buying designer handbags and expensive watches, they consume significantly less of their income in percentage terms.

* Foreign direct investment in China fell in relation to GDP from over 3 percent between 1999 and 2012 to around 1.5 percent of GDP today; it no longer plays the same role as ten years ago.

Exports have also lost considerable importance. Before the global crisis, they peaked at 31 percent of GDP, and are since declining. Exports have hardly grown at all since 2014, even in absolute terms. At the end of 2017, they accounted for just 19 percent of GDP. The share of imports to GDP developed similarly, but this is characterized by stronger ups and downs as a result of slumps in growth in 2015/2016 and 2019; its share of GDP was 18 percent in 2017. Imports and exports in relation to GDP in China are thus roughly on a par with India – exports 19 percent and imports 22 percent. Germany, which is extremely export-oriented, accounts for 47 percent (exports) and 40 percent (imports) of GDP, while France sits at 31 percent and 32 percent, respectively, and the USA at 12 percent and 15 percent. China’s foreign trade surplus fell to 0.4 percent of GDP in 2018 and is estimated to turn negative in the coming years.

* Government infrastructure programs are becoming increasingly inefficient. To name just one example among many: the utilization rate in China’s metros (passenger per kilometre) is only two-thirds of the international average in the rest of the world. Since the metro systems in the metropolises are very overcrowded – standing in line for half an hour during rush hour is not uncommon – this means that many newly built metro lines in other cities have an extremely low utilization rate. This is not due to the lack of passengers, but to the fact that subway construction is oriented towards investor’s interests and land development plans.

* Investments are very unevenly distributed regionally. While many economically backward provinces have been able to catch up with higher growth for some time, their growth over the past few years can at best keep pace with the coastal provinces, but cannot hope to speed up and bridge the gap. In the future, they will probably fall further behind the large industrial centers and become even more dependent.8 Due to US tariffs, the relocation of production facilities from the more expensive coastal regions to the interior has become even less attractive.

The governments of many poor provinces are highly indebted compared to the national average of 60 percent of the provincial GDP Qinghai (80 percent), Gansu (85 percent), Yunnan (115 percent), Guizhou (170 percent).9

Last year, plans were published for the promotion of three major regions: the region surrounding Shanghai, the Greater Bay Area, connecting Hong Kong, Shenzhen, Guangzhou and Macao, and Beijing with its surrounding area of Hebei province and neighboring city of Tianjin. Housing prices in these regions rose again immediately. This continues the redistribution in favor of property owners in the already developed metropolises. Migrant workers often do not return to their villages, but to developing city near their former villages. There, consumer goods for daily needs are hardly cheaper than in the metropolises, but wages are lower and schools are worse. With declining investments in infrastructure, it will become harder to find jobs there in the future.

996

The authoritarian management is not improving. At the beginning of 2019 an online discussion about the so called “996 work system”, widespread in Chinese tech companies, sprang up. 996 stands for working from 9 am to 9 pm in the evening, six days a week. Not only in factories, but also in offices, long overtime is very common. In software companies, the 996 system developed around 2014, when the demand for programmers exceeded the supply and companies were willing to pay high wages for long working hours, and offered good career opportunities. With the strong withdrawal of venture capital in 2018, many software companies began to lay off staff. Overtime remained, but wages did not rise as sharply, and opportunities for advancement dwindled. This was probably one of the reasons why the middle class suddenly expressed dissatisfaction with wages and working conditions.10 Despite lively and colorful discussions online, little changed in practice. Huawei and Alibaba are among the best-known companies practicing the 996 system or defending it in public debate. In a number of striking examples, the same tech bosses who want to secure their future profits with AI, autonomous cars and computer chips, like billionaire Jack Ma, former head of Alibaba, are among the most vehement defenders of massive unpaid overtime and the 6-day working week. With the Huawei boss Ren Zhengfei, who was in the military for ten years, everything comes together, including the 996 overtime system.

“996” shows how Chinese bosses intend to apply the same management system used in Chinese factories to software production. While wages in tech are higher, they rely on cheap incentives like free pizza, while workers stay in the office until 21:30. The goal of achieving absolute surplus value by hiring young workers and lengthening the working day remains the same, though consequently, they are unable to compensate workers with rising wages in line with productivity gains. Management in such companies is authoritarian, or at best paternalistic. Contrary to company propaganda about bottom-up, or horizontal decision making at “progressive” tech firms, decisions are made at the top, and followed at the bottom, and those who are at the bottom are considered inexperienced and unimportant. Like other workers, programmers often change jobs in order to improve wages step by step. But redundancies in the industry are making this strategy increasingly difficult. Based on my own experience, one doesn’t have to believe in the illusion of flat hierarchies to see the inefficiency of the really existing management conditions in software production. In programming, where knowledge of a project’s source code and internal project communication are very important, projects don’t go very far if turnover is high, nor is much progress made when managers do all the talking and decision making in meetings, while they don’t work on the code themselves. This is a common problem in the software industry in other countries, too, and new, so called agile management form were introduce to engage programmers in the whole development process. Even though buzzwords like “agile” are common in the IT industry in China, but as the 996 debate shows, these are often only fashionable names for unchanged authoritarian management. Overtime usually results from poor project management, but when those who work the longer hours are given no choice but to sacrifice their free time and are discouraged from giving feedback, little will improve. At present, however, the costs of such inefficient work organization can still be absorbed by venture capital, the large Chinese market and low wages in other sectors. The 996 debate thus shows how little bosses in China are willing to move away from authoritarian labour relations even as new industries emerge.

From labour surplus to labour shortages

The average age of migrant workers rose from 34 to 40 years between 2008 and 2018, and those over 50 now make up almost a quarter of all those classed as migrant workers. Experience in dealing with wage arrears or bosses trying to cheat their workers also increases with age. In terms of wages and wage growth, there are clear differences between manufacturing and logistics on the one hand (which increased by 6.8 percent to approximately 4345 RMB in 2018) and services and hospitality on the other (increased by 4.3 percent to just over 3,000 RMB in the same year).11 The average wages of employees and skilled workers grew by about 7 percent until 2018.12

Fewer and fewer young people are willing to work in factories, and wages in manufacturing have, subsequently, become higher in manufacturing than in the service sector. Every year, more than 8 million university graduates enter the labor market. They have invested a lot of money and effort in their education, and they have correspondingly high expectations for jobs, like expecting steady wage increases in the decades to come. During the last few years, the rapid growth of e-commerce and internet services such as food deliveries, taxis, etc. has served as a temporary remedy to problems in the labor market by creating new venture capital-subsidized jobs for workers in the services sector. But now growth rates are slumping in this sector too.

The decline in the number of workers as a whole has already begun and will accelerate in the coming years. Between 1978 and 2010, the population aged 15-64, generally considered the working age population, grew by 80% or 1.8% annually from 580 million to 1 billion workers. But since 2010 the numbers have stagnated, and beginning in 2015 it actually began to shrink slightly. The shrinkage is gradually accelerating. Between 2015 and 2040, the working age population will decline by well over 100 million to 880 million people. After 2040, it will fall by 1 percent annually. For the younger age groups, the decrease is particularly pronounced. The 15-29 year olds will decrease by 75 million, or almost a quarter, and the 30-49 year olds by 100 million, also a quarter.13 It is estimated that in 2040 half of all Chinese will be over 47 years old and 22% will be 65 or older, which is comparable with Germany today. The official retirement age for women is 55, and 60 for men, and the government hasn’t dared to raise it so far. Despite considerable social pressure on young couples to have children, birth rates are low. Among the most important reasons are expensive housing, expensive education, job insecurity, and discrimination against women in the workplaces. Even if birth rates rise sharply, this will not alleviate the decline in the labor force by 2040. Bringing foreign workers into the country is hardly possible at such a scale, and would pose entirely new challenges to the political order.

Population policies, most significantly the one child policy, have led the Chinese extended family, the nucleus of social provision and control, to its historic peak and now to its decline, even in spite of recent moves to loosen, and even eventually abolish the decades-long one child policy. The increase in life expectancy and the high birth rates during the Mao period have led to an enormous increase in the number of living relatives and marriage had become the inevitable norm. Around 2000, over 96 percent of the population married at least once in their lives. This and the wealth gains of the boom years allowed the Confucian tradition and family values to flourish in the last ten years. People in their 50ties, 60ties and 70ties have on average larger networks of living relatives than a 50 years ago. And the wealthy also often celebrate these networks through opulent weddings, funerals etc. But this is a specific and limited historical phenomenon. Since there are more men than women, and even without accounting for the declining marriage rates, a quarter of men aged around 40 are expected to be unmarried by 2030. The positions of power in society and patriarchal families are still predominantly held by men from generations with many children and living relatives. But they age and with them the extended family will gradually disappear and inevitably die out. In 20 or 30 years, the networks of living relatives will be significantly smaller due to the low birth rates and fewer siblings in each generation and this will likely bring changes for a society which put so much emphasis on family relations.

The old power base vs. opening tendencies

The reform of state-owned enterprises (SOEs) has been stagnating for years. On average, the profits of SOEs are increasing, but their profitability differs a lot, some serve social stabilization and job retention (in areas like steel, construction, and transport), others are very profitable and form state monopolies in tobacco, oil, raw materials, banking, and telephone networks – and automobile sectors (although there is no technical monopoly in the auto sector, and there are a considerable number of joint ventures with foreign firms). Overall, they contribute very little to job growth, but account for 40 per cent of GDP, and about two thirds of turnover for listed companies.

The Chinese stock market is essentially a market of SOEs. Its further opening would require reform of corporate management for SOEs, because investors want to be able to influence corporate decisions. So far, this power has been in the hands of the CCP, which has even expanded its intervention in recent years. In addition to the influence exerted by legal means, public decrees and state-owned enterprises, private (Chinese or foreign) companies also have to set up internal party committees that increasingly interfere in company decisions. The establishment of company trade unions in foreign companies has recently been expanded, through orders from above. My department, too, has established a trade union committee this year, and the head of our department is the chairman. We sometimes get cinema vouchers, or other cheap gifts, and the company’s annual family day activity is now organized by the trade union group, but otherwise it only exists on paper.

The financial industry, on the other hand, appears to be more open to foreign investors and their desire for reform. Several foreign financial institutions are now allowed to acquire a majority stake in their joint ventures. The liberalization of joint ventures in other sectors (including car manufacturers) should also not be overlooked. One part of the ruling elite is more interested in further integration into global capitalism than in confrontation with the USA. Government-related and former government members utter covert criticism of the political course, seen as reversing Deng Xiaoping’s reforms.

Have the Dice Been Cast?

While the past is gloomy, the outlook is even darker. Who will pay for the gigantic mountain of debt accrued over the last ten years? And how will future wage increases be paid for? The greatest dangers are a sudden collapse of sky-high overpriced housing prices, and an increase in unemployment.

For years, expectations have been raised that China will automatically catch up with, and outperform the US by around 2030. However, this assumes growth rates of four percentage points above that of the US. This is still possible this year, but only by rapidly growing overall debt, so it is very questionable whether such high growth rates can be sustained long term for China. To catch up by 2035, growth would have to be about three percentage points higher than the US, and to catch up by 2040 about two percentage points higher, but the – hardly foreseeable – the demographic crisis will by then already have massive effects on the economy. A “lost decade”, as has occurred in Japan, with very low growth rates, or a visible defeat in the trade war, would not go down well with China’s nationalistic expectations. The population decline stands in China’s way as the world’s hegemon, and it will become even more acute in times of trade wars. However, few options are left for future economic development:

If the government were serious about increasing domestic consumption, wages would have to increase and wealth would have to be redistributed on a large scale by the state, from corporations and rich “private individuals” to the working class. Even then, the economy would grow more slowly! But the ruling elite is not willing to accept this massive loss of power and wealth.

The second option would be a complete opening for foreign investors – i.e. the “shock therapy” à la Eastern Europe after the fall of communism. The complete opening, including large parts of the internet and the media (as apparently demanded by US trade negotiators14), poses a great risk to the CCP.

The reformist option would be to climb up the global value chains and open up new, foreign markets through imperial geographic expansion, and this is where China encounters opposition from the USA.

Policies in recent years clearly show that the third option is being pursued (i.e. geographical expansion and ascension in the value chains). It is precisely these policies that have led to the “trade war” with the US.

Industrial Policy

Industrial upgrading in China has advanced to a point where it is beginning to challenge the competitive edge of the US. The productivity gains in toy, shoe, railway, construction machinery, automotive, household appliance production over the last two decades do not pose as great a challenge for US industry as in more advanced areas like industrial policies targeting AI, semiconductors, biotechnology, 5G network infrastructure, cloud computing, aircraft construction, quantum computing, financial technology and others. Losing the advantage in these areas would be painful for the US, especially in these days of weak global demand.

The industrial development plans of the last 15 years, such as Made in China 2025, focus on the following sectors: machinery for agriculture, shipbuilding and marine technology, electric vehicles, new generation information and communication technologies, machine tool systems and robotics, electricity, aerospace, new materials, rail transport, biomedicine and medical devices. The development of new powertrains, and new value chains like those around batteries for electric vehicles, is intended to establish new Chinese car brands. The growing demand for energy is to be met by nuclear instead of coal-fired power plants. The world’s largest high-speed train network needs many locomotives, and the mechanization of agriculture will require tractors and other advanced machinery, etc. China imports over $200 billion worth of semiconductors and computer chips annually, and the growing domestic air traffic needs Boeing and Airbus aircraft. Here, China’s industrial planners see an opportunity to gain market share through import substitution, and are trying to invest parts of their enormous investment funds profitably. The national champions of the last decade such as Huawei, Tencent, Alibaba and Baidu are particularly benefiting from the promotion of chip manufacturing, AI, etc. But chip manufacturing is extremely capital-intensive and already suffering from dwindling profits.

Most of the sponsored key industries are also relevant for the military. High-tech sectors, industrial policies and the military have joined forces to form a military-industrial complex that is increasingly being promoted with the development of new weapons systems. The development of digital surveillance at home benefits the same high-tech sector.

Growing Militarization

In order to secure China’s demand for raw materials alone, Chinese state-owned enterprises have invested considerable portions of their export surpluses abroad. In addition, there are numerous other foreign investments (China’s foreign investments stock of around $1.5 trillion is just behind those of Germany or France) as well as government programs such as the Belt and Road Initiative (BRI), industrial parks, ports, etc. But since 2017, China’s foreign investment has been declining. Investment in the BRI are declining too, over the five years between 2014 and 2018 it summed up to around $400 billion, a huge number but compared to the much advertised total volume of several trillion US dollar it is much lower than expected.15 The future of China’s investment in the BRI depend on its (positive) trade balance.

China is now the most important trading partner of 124 countries. By comparison, the US only plays this role in 85 countries. Of course, this also increases the possibility of exerting influence. In global capitalism, global economic activities require either the integration into the pax americana, including indirect tribute payments, or their own global military presence. China chooses the latter and increasingly secures ownership claims to foreign investments and trade goods militarily. In the South China Sea, artificial, militarized islands have been built, and its naval weapons systems are being modernized, with aircraft carriers, submarines, guided missile destroyers, ballistic missiles, combat aircraft, and the first overseas military base in Djibouti, all of which increase the operating radius beyond the coastal waters. Work is also underway on new weapons systems such as hypersonic missiles, drones and swarm drones, and weapons to destroy enemy satellites. Domestically, the military has also visibly gained power. Xi has increased the military budget, organized major military parades, and recently increased the punishment of critics of the military.

In diplomacy as well, the CCP has taken a more assertive stand. The clashes over the THAAD missiles in Korea, the three tourists in Sweden, the arrest of the Huawei manager in Canada, NBA scandal and the deportation law in Hong Kong show that China’s diplomacy is becoming more aggressive. Beijing has been able to persuade other countries to end their diplomatic relations with Taiwan. The principle of “one country, two systems” has failed in Hong Kong. Beijing wants to enforce the same on Taiwan – there, too, against the overwhelming majority of the population.

Repression of Wages

The Made in China 2025 plan completely neglects the question of how to improve and adjust training of workers in relation to industrial automation. Increased productivity is conceived of solely through investment in constant capital. There have been repeated attempts by governments to improve productivity and unit costs in existing labor-intensive industries through greater involvement of workers and gradual rationalization. However, attempts to gradually and comprehensively reduce unit-costs are apparently too difficult to implement under the given state bureaucracy, its decision-making structures and the power of workers, such as relatively easy job switching.

In recent years, wage developments have been relatively stable, but much slower than before the stock market crash of 2015. It is difficult to say whether this trend will continue in a similar fashion through the end of 2019 and beyond, as there have already been many redundancies in several sectors.

Minimum wage increases in 2019 were significantly lower in all provinces than in previous years. The minimum wages continue to fall in relation to the average wage and sit at just 23 – 27 percent of average wages in the Pearl River Delta.16 Moreover, the spread of formal employment contracts is stagnating not only in construction and other blue collar jobs, but also in many office jobs. Overall, the presence of formal contracts fell from 44 per cent in 2012 to 35 per cent in 2016, saving companies social security contributions and possible compensation for work-related illnesses and more.17

A massive reduction in social wages can be observed in education, health and old-age protections. The city of Shenzhen, recently designated as a future international model metropolis, for example, offers a place in a high school for only 47 percent of secondary school pupils (plus 10 percent in expensive private schools). By comparison, Guangzhou offers 67 percent and Beijing 85 percent.18 It is said that Shenzhen is short of land to build more schools, while the vacancy rate for office space is 23 percent and more offices are currently being built, accounting for 80 percent of the total office space.19 The competitive pressure has thus created a boom for private schools and tutoring.

In the healthcare sector, public hospitals are not being improved, and instead investment opportunities are being created for private hospital operators. Private health insurance is another potentially profitable field, as China’s population is aging rapidly and many civilians have little or no health insurance coverage. Alibaba’s private health insurance already has 50 million contributors, many of whom have never had similar health insurance before. It is not officially considered insurance and is therefore not regulated.

The problems associated with the rapid aging of China’s population are compounded by a completely inadequate pension system. The employer’s contribution to the state pension scheme was recently reduced from 20 to 16 per cent, while the employee’s share remained unchanged, i.e. a de facto wage reduction of four per cent, which is not immediately noticeable.20 The pension fund for municipal employees, for example, is estimated to run dry by 2027 after this reduction in employer contributions.

Since 2017, 600 selected state-owned companies have been instructed to transfer a tenth of their shares to government pension funds, but to date only five of them have done so! This shows how unsuccessfully redistribution from above is being enforced.

Repression

In addition to the suppression of wage demands, there is the intensified general repression against feminists, LBTQ, punk concerts and all kinds of social protests. Police, who told some friends in China not to organize a public discussion about the situation of single mothers, explained that this year, they have to pay special attention to the activities of “young people” in general. Xi’s anti-corruption campaign, the tightening of censorship and control over universities and the media are further examples of increasing influence that is neither legally mediated nor transparent or predictable. For 2020, the introduction of the much-discussed social credit system is announced, which will further expand surveillance, data collection, blacklisting of unwanted persons, opaque discrimination and all sorts of bureaucracy, and reduce real wages through new fines. More than 17 million Chinese are already blacklisted and excluded from buying air or rail tickets.21 It is still unclear, however, how rewards for good behavior are financed and how arbitration in case of dispute will be handled. This computer-assisted attack on the working class appears just as nightmarish as it seems questionable whether a second regulatory system besides that of the law, police and judicial courts will be less corrupt, and whether the many sensitive personal data will not immediately be stolen or manipulated by cyber attacks.

In addition, there is the continuing failure of the authorities to guarantee food and drug safety or disease protection. Despite a number of government measures to cut costs, pharmaceutical companies have been able to noticeably increase the prices of many medicines. To summarize the policies on minimum wages, repression and privatization, it looks like the state tries hard to keep real wages low, although average wages are still increasing significantly (at least until 2019).

The worst swine epidemic of all time

But the worst of all is the impact of African swine flu, the worst animal disease in recorded history. It was allegedly brought under control in August 2018, but is still spreading today.

Half of all pigs worldwide are bred in China, where 56 million tons of pigs were consumed in 2018. The hog population has already fallen by 40 percent – more than the entire European hog population. In 2019, production is estimated to fall by 12 million tonnes; total global pork exports are around 8 million tonnes; even if China were to buy everything, it would not be enough to fill the gap. By the end of 2019, the total number of pigs is expected to continue to fall. It will take years to revive production because the stock of breeding sows has also fallen by almost 40 percent. While consumption of pork has dropped by an estimated 10-15 percent, meat prices have risen by well over 100 percent.22 Pork is already rationed in Nanning.

The share prices of major Chinese pork producers have risen significantly because prices are rising, subsidies are flowing and the concentration of pig farms is being massively pushed forward in the wake of the epidemic.

The consumption of pork also has a great symbolic significance. Since the beginning of reform and opening up, pork consumption has been systematically increased, followed a little later by milk consumption, so that everyone is given the feeling that things are going well and that their standards of living are improving.23

A clash of cultures or of classes?

The party propagates the building of an affluent society on every occasion. But the planners in Beijing have understood that they can hardly overtake the USA in the near future. Their labor market policy since the stock market crash in 2015 is clearly pushing for falling or stagnating real wages, partly by directly combating strikes and workers’ activists, privatizing education and health, slow increases of minimum wages etc.

On the other hand, nationalist propaganda and the pressure to make patriotic declarations of loyalty is on the rise, as shown by numerous examples related to the protests in Hong Kong. State media portrais protesters as perpetrators of violence and terrorism and as instruments of foreign powers. Digital memes to support the police are provided by state media outlets, which are then distributed by eager readers through social media. Especially young so-called “keyboard warriors” support each other in setting up VPNs to overcome the firewall and launch joint campaigns to laud the police and demonize the rebellious Hong Kong youth on the censored pages of Facebook and Twitter.24 Many stars and starlets and even Chinese rappers take part in this. But the CCP cannot tolerate any social movement – not even a nationalist one! When the controversial extradition law was completely withdrawn and the nationalists complained about it online, their posts were quickly deleted.

As ugly and alarming as this nationalist spectacle is, the question remains as to how much willingness to make sacrifices lies behind the patriotic lip-service of middle-class Chinese, especially if they live abroad. Regardless of their expressions of loyalty, they will probably prefer to move wealth out of China if the RMB continues to fall.

What is striking about the coverage of the “trade war” is how many emotions and anthropomorphism are projected onto the two contending parties – not only in propaganda, but also in supposedly neutral analyses. The US is frustrated, the escalation is the result of disappointed trust. … The portrayal of countries as persons who feel, trust and decide like a human being is deliberately falsifying.

Therefore, we must discuss a few myths that can even be found among parts of the left:

* Chinese Maoists often explain low wages in China through pressure from multinationals. But foreign investments are now increasingly targeting the domestic market over the production for export; moreover, foreign capital accounts for only about one thirtieth of investment in China. To attract foreign investors, opening the market and increasing transparency and legal certainty would be more important than wage repression. But this is the argument of the–

* democratic market reformers. They demand reform of SOEs, reduction of the high tax burden, privatization and want to do away with state mingling in the economy! They argue that private companies are more profitable than SOEs. The Chinese state owns about 27% of China’s total assets (slightly more than its annual GDP).25 During the Mao period, the figure stood at two-thirds, but compared to the USA or European countries, with about 0% after deduction of government debt, there is still a lot to gain from privatization. But the market reformers only think of their own pockets and if government influence and thus also repression is reduced and bad debt of local governments and SOEs revealed, reformers would face stronger wage demands and workers struggles – then state assets could melt away quickly.

* The Maoists in the West and their “anti-imperialist” fellows have been praising China’s exemplary character for a long time, some even insisting against all evidence that China is still socialist. Such idiocies lose their political significance. But many continue to refer to China as a pacifist alternative to the US hegemon – another increasingly absurd idea. Arguing that China is not an imperialist country because the profit margins of its companies are lower than those of their US competitors is also misleading.

These Maoist arguments do not put the focus on the class antagonism within China, but point to a global antagonism between China and the West, and hence end up with the same arguments as the regime. On the contrary, not the US tariffs are the main challenges for the rulers in Beijing, but the increased expectations of the wage earners in China and the inability to satisfy them from the weakening profits.

China and the USA, like the rest of the world, are experiencing a deep crisis of over-accumulation in which accumulated capital and existing or potential production capacities far outstrip solvent demand. The worldwide slump in car sales and the enormous income and wealth inequality are just two examples among many. As in the past 18 months, the trade disputes will continue to experience a lot of back and forth as capitalists of both countries try to shift the disadvantages on to others. But the prerequisite for resolving the conflict is to solve the over-accumulation crisis. If new markets could be opened up overnight, offering rising profits for all as in the boom years, then Xi and Trump would quickly agree. But such untapped markets no longer exist. Another solution to over-accumulation would be the redistribution of wealth – or the destruction of capital in trade or real war.

In his 1977 long analysis “Food, Famine and the International Crisis”, Harry Cleaver pointed out that the alleged “food crisis” of the 1970s was at the center of international class disputes. The Soviet authorities’ inability to feed their own working class led to massive imports of grain to produce meat. (“the demands of the Russian and Eastern European workers, to which the state had to respond, did not aim for more bread, but for more meat.”)26 The loans that had to be taken out for this led to the erosion of the USSR, which Reagan put an end to with the strategy of “arms race” in the 1980s. Today the problems for China are similar: the workers have fought for a standard of living that can no longer be financed with the business model of the “workshop of the world”. The Chinese investments in trade routes and raw materials can be seen as another parallel to the USSR and its massive investments to develop Siberian oil in the 1980s. Both pursue(d) self-sufficiency as a political goal, and in return accept declining yields, which is aggravated in the case of oil by China’s high dependence on imports.27 Will swine fever deepen the problems? Will the military’s thirst for oil become the Achilles’ heel? Will the arms race lead China to follow the Soviet Unions’s fate?

By its offensive strategy, the Chinese government is attempting to combine global economic, political and military influence with domestic wage repression and authoritarian social control and work organization (state, management). This leads to confrontation with the US and, furthermore, the rulers in Beijing attempt to lower wage and consumption levels through currency devaluation and inflation, distract the attention of people in China through the promises of becoming a great power, suppress resistance through censorship and repression, and reduce cultural exchange with foreign countries. So far this has been opposed by the resistance of workers and wage earners. The wage development shows that the government cannot not easily push through with wage depression. Wage growth is lower than in the boom years, but the difference to GDP growth has narrowed considerably. Wages are again growing more slowly than GDP, but the gap has narrowed sharply compared to the export boom years before the financial crisis, especially in the manufacturing industry. Profit increases similar to the boom years would require a cap on wage increases of at 2.5 instead of 6.8 percent!

This would obviously require more drastic means than suspending minimum wage increases and closing workers’ NGOs. Here, the CCP faces a dilemma, because it does not dare to reach for the otherwise so popular weapon of the capitalists and increase unemployment.

As a temporary way out, propaganda is heating up. State media projects images of strength and self-confidence. Xi explains that China is well prepared for the trade war and state television shows anti-American films and evokes the spirit of the Long March. Many ordinary people with whom I have spoken do not feel a direct impact of the trade war on their everyday lives yet. But put in perspective, the trade war is about all our working and living, housing and eating, health care, education, and so on. All this is directly and largely determined by the very politics that try to escape from domestic contradictions into the imperial confrontation. This confrontation is undoubtedly the worst decision for the people of China: even if you take the nationalist argument seriously that China must build and defend its power and independence against other – capitalist – countries. Real wage cuts and poor education and health care are the price people should, according to the CCP, be willing to pay for building a domestic microprocessor industry. The vast majority people in China, the US or elsewhere would benefit from the redistribution of wealth, but they neither benefit from domestic chip development nor from military armament, and are excluded from the political decisions that led to the escalation.

Concerning Beijing’s role, after looking into all the developments discussed above, I’m convinced that the timing for this escalation was not strategically chosen according to when the Chinese economy and the military would be ready – it is likely to come too early and too late for both sides at the same time – but set by internal dynamics. The end of the growth model and the expectations of the wage-earning class have presented the ruling elites with the choice of either entering into a foreign policy confrontation now or failing internally because of class contradictions. Perhaps Xi and Trump will fail on both fronts?

Notes

1 See for example Michael Pettis, The Great Rebalancing.

2On wages of migrant workers during this period, see http://people.anu.edu.au/xin.meng/Surplus_Labour_final2.pdf and people.anu.edu.au/xin.meng/wage-growth.pdf

3https://www.imf.org/external/pubs/ft/wp/2015/wp15151.pdf

4Since wage increases are nominal and not inflation-adjusted, we must also compare them with nominal GDP growth. For wage growth, see: http://www.ftchinese.com/story/001071536/en

5Victor Shih, China’s Credit Conundrum, New Left Review, Nr. 115, Jan. Feb. 2019.

6https://www.theglobaleconomy.com

7https://blogs.imf.org/2018/09/20/chart-of-the-week-inequality-in-china/

8Reuters, https://www.reuters.com/article/us-china-economy-revenues/chinas-tax-cuts-hit-local-government-coffers-may-undermine-stimulus-idUSKCN1UR3MT

9Tom Hancock, China’s regions hit by infrastructure spending downturn, Financial Times, https://www.ft.com/content/1eb6d9ac-be6e-11e9-b350-db00d509634e

10https://madeinchinajournal.com/2019/06/18/the-996-icu-movement-in-china-changing-employment-relations-and-labour-agency-in-the-tech-industry/

11China Labour Bulletin, https://clb.org.hk/content/migrant-workers-and-their-children

12South China Morning Post, https://www.scmp.com/economy/china-economy/article/3008273/chinas-white-collar-workers-earned-less-first-quarter-2019

13https://www.hoover.org/research/chinas-demographic-prospects-2040-Copportunities-constraints-potential-policy-responses

14 https://www.scmp.com/news/china/diplomacy/article/3012049/was-moment-us-china-trade-talks-fell-apart

15https://www.washingtonpost.com/outlook/five-myths/five-myths-about-chinas-belt-and-road-initiative/2019/05/30/d6870958-8223-11e9-bce7-40b4105f7ca0_story.html

16Worker Empowerment, http://www.workerempowerment.org/en/publication/362

17Kevin Lin, https://www.eastasiaforum.org/2019/08/27/the-end-of-chinas-labour-reform/

18https://www.scmp.com/economy/china-economy/article/3024730/shenzhen-set-be-chinas-new-model-city-why-are-parents-losing

19https://www.caixinglobal.com/2019-06-19/tech-hub-shenzhen-hasnt-had-this-much-vacant-office-space-in-10-years-101428940.html

20 https://clb.org.hk/content/pension-contribution-rates-employers-across-china-cut-16-percent

21https://www.scmp.com/economy/china-economy/article/2186606/chinas-social-credit-system-shows-its-teeth-banning-millions

22https://research.rabobank.com/far/en/sectors/animal-protein/african-swine-fever-affects-china-s-pork-consumption.html

23 Mindi Schneider has written about the role of increasing pork consumption in China extensively.

24https://www.scmp.com/news/china/society/article/3024223/emergence-and-evolution-chinas-internet-warriors

25http://www.chinadaily.com.cn/a/201812/27/WS5c24446fa310d91214051414.html

26Harry Cleaver, Food, Famine and the International Crisis, https://libcom.org/library/food-famine-international-crisis-harry-cleaver-zerowork

27https://www.forbes.com/sites/edhirs/2019/06/06/china-is-betting-big-on-increasing-oil-production