The following article was originally published on Tootopia (土逗公社), probably the most popular platform for Chinese left millennials (until it was shut down in the latest wave of anti-left repression), toward the end of October 2018.1 The data used below therefore ends in the third quarter of 2018. We translated the piece in the winter of 2018-2019, then checked in with the author to clarify a few points. After this, we promptly became busy with the final preparations for the release of the second issue of our journal, and this translation was placed on the back burner. We release it now in the wake of the collapsed trade talks between the US and China, which has only intensified many of the tendencies identified by the author below. We plan to explore updated figures in upcoming blog entries.

The piece mostly speaks for itself, but it will be helpful to explain both the context of its production and distribution within China, as well as how it relates to (and differs from) our own analysis of similar trends. Jiang Xia, the author, explains that they don’t “belong to any tendency or faction,” and instead simply “hopes to be able to produce a Marxist interpretation of the many phenomena within China, from a working class standpoint—with a particular focus on political-economic questions.” Without betraying the author’s anonymity, we can simply say that they are a university student within a coastal city. This is an important point, however, since it shows one way in which students within China have been again engaging with Marxist thought. Here, we see a more earnest, albeit slightly more academic, form of engagement with classical Marxism, fairly well attuned to Marx’s actual writings. This stands in contrast to many of China’s politically active student groups, who, though earnestly interested in similar questions, tend to filter their analysis more through Mao and Lenin rather than returning to the source in Marx. While such groups are of interest in and of themselves (and we have begun a series of articles exploring their character in relation to “the Jasic struggle”), this piece instead offers a window into the more complex theoretical topics beginning to be tackled by younger members of the Chinese left.

The author clarifies that, “though the article explores very important questions, the answers it itself offers are fairly rough. This is partially due to its length, but it’s also because I haven’t completely clarified by own line of thought on these questions.” Instead of giving elaborate answers, the author encourages readers to think of the conclusions at this stage more as “hints and clues.” No more detailed version of the piece has been published in the intervening months, though the author has since printed two more recent articles, both focusing on aspects of China’s social insurance system and the problems of an aging workforce.2 As a rough sketch of the general crisis dynamics in the country, we find that the author’s points of focus tend to be similar to our own: the building crisis in employment as the rural labor pool reaches a saturation point; the various debt bubbles, particularly those connected to real estate; and the overarching theme of capitalism’s “fetish of growth,” which is not a mental limit but a material necessity of the system. Overall, then, we feel that the author’s major themes overlap substantially with our own, and we will cover much of this material in more detail in the third and final part of our economic history (and more briefly in blog posts preceding this).

One point of potential divergence from our own interpretation of Marx’s work is worth noting, however. The author tends to make an assumption common to the Chinese left, wherein state and capital are seen as strongly distinct. Though their interests may be convergent at the moment, this is seen as an historical contingency, not a necessity of the system. Among the academic left in China, there is a default equation of the state with “the people.” Empirically, this is a problem because it ignores the degree to which the state today is literally led (at all the true decision-making levels) by individuals who can only be described as capitalists.3 Theoretically, it ignores the necessary role the state plays in “original accumulation,” which is not an historically delimited “stage” of capitalism (as old interpretations of “primitive accumulation” often imply), nor simply a shorthand for continuing “accumulation by dispossession,”4 but is instead the process whereby the baseline conditions for capitalist accumulation are both lain and continuously maintained. The category therefore encompasses both the historically-specific—and as a rule incredibly violent—imposition of the capitalist system across the world, as well as the broader processes of social reproduction necessary to its continuation. The latter includes social and cultural practices, as well as the gender and racial structures constantly produced and reproduced by the system. But it also includes the role played by the state, including its capacity as the “enforcer” of growth, to borrow a term from the author.

Politically, the presumption of a state that could act on behalf of the “the people” if it wanted to tends to trail popular consciousness itself. Our experience has been that most Chinese people, and certainly most of China’s proletarians, seem to have a more or less clear understanding that the state fundamentally does not serve their interests. The author of this piece is ambiguous on this question, but in some places seems to make the common assumption of the academic left. This is particularly visible in the piece’s explanation of the state’s role in investment, which the author is correct to note “exceeds Keynesianism.” But the exact implications of this remain unclear, and the author seems to infer that it would be at least possible for the “visible foot” of the state to “tame the invisible hand” of the market. We argue that this very opposition is itself an illusion: a “fetish of the state” to complement the “fetish of growth” so well described by the author.

–Chuang

Introduction by the Tootopia editors

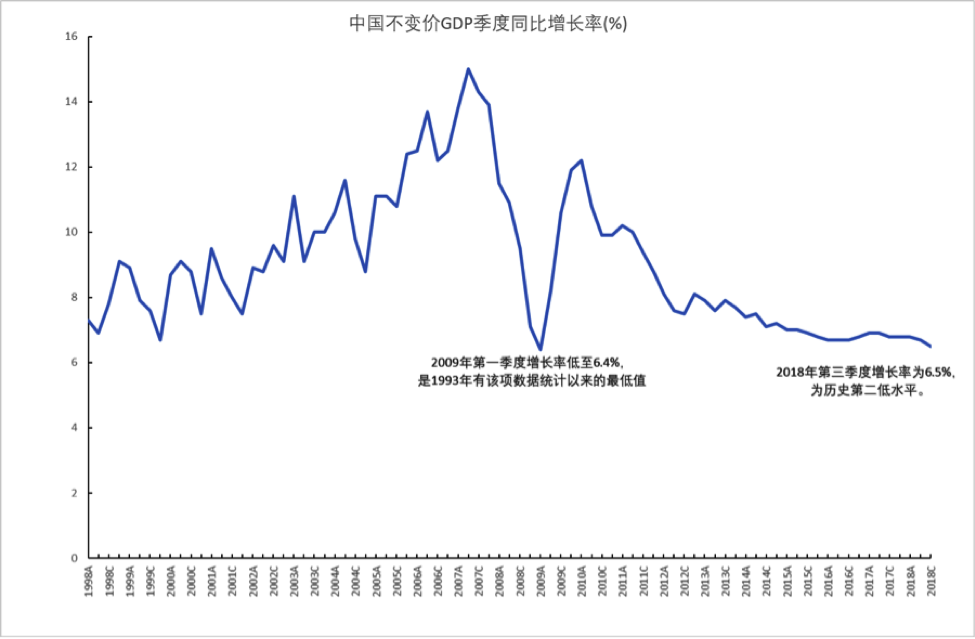

In the third quarter of 2018, national GDP increased 6.5% (year-over-year). If we were to purely look at the number itself, it appears not to be such a bad achievement. After all, the world GDP growth rate in 2017 was a mere 3%. But, from the viewpoint of various macroeconomic indicators, the outlook is not particularly optimistic. It seems as if we’ve already become used to economic growth, and we take it for granted that growth is a good thing. But we forget to examine the crucial question: Why do we need economic growth?

A bubble of granite is still a bubble.

The Harsh Winter of Your Employment Safeguards the Economic Growth of the Nation

By Jiang Xia

Current macroeconomic conditions in China are making people worry.

According to the latest data from the Chinese National Bureau of Statistics, GDP growth was 6.5 percent in the third quarter of 2018. This is the second-lowest quarterly growth in all the years since 1993. In terms of demand, over the last few years investment in fixed assets, retail sales, and government expenditures have all reached their lowest levels of growth. All have been influenced by the US-China trade war, with the future of exports not looking hopeful. In addition to this, cumulative new social financing5 prior to the third quarter was 14.45 trillion RMB, 1.25 trillion less than that for the same period in the previous year. The domestic stock market and RMB foreign exchange market were also just barely performing at a satisfactory level. Since the beginning of the year, the Shanghai and Shenzhen Indexes have dropped 23.83 percent and 33.91 percent, respectively, and the RMB-to-USD exchange ratio has fallen by 8.77 percent.

Data: National Bureau of Statistics

In recent years, the government has been advocating the concept of a “new normal” for the economy in order to revise people’s expectations about economic growth. On the surface, it doesn’t seem to be a serious problem for growth to slow down a little, especially considering that 6.5 percent is still among the highest rates in the world. If we were speaking of a household, even if your income didn’t increase at all it wouldn’t be a problem, it would just mean that this year would be the same as last year. Many people intuitively use the conditions of the household as an analogy for the national economy in this way, but the logic of the latter is simply not the same. In fact, a growth rate of 6.5 percent is sufficient to strike deep worries into many Chinese firms, which now fear danger from all sides—fears that are particularly acute among private firms.

In this short period of time, the central leadership has unceasingly issued statements in support of private business and even made steps toward fulfilling the unceasing demand to decrease taxes and lower costs. It can clearly be seen that the logic of a national economy and that of a household are two completely different things. The consequences of growth or decline are not symmetrical between the two: for a national economy, slowing growth is a problem, stagnation is a disaster, and a decline is simply the end of the world.

So how has economic growth become the crucial requirement around which all of modern society revolves?

People’s Daily: “Let enterprises benefit from substantial tax breaks.” (11 October 2018)

Economic Miracles, Kuznets Cycles and the Fetish of Growth

Marx once gave this elevated appraisal of the advance of the productive forces wrought by capitalism: “The bourgeoisie, during its rule of scarce one hundred years, has created more massive and more colossal productive forces than have all preceding generations together.”6 Before the capitalist era, many people considered history to be cyclical. But the massive advance of the productive forces under capitalism upended old cosmologies. Growth and progress were gradually made into articles of faith—people now wanted to believe that tomorrow would always be better than today, and that the son would always be better off than his forefathers.

Over the past forty years, Chinese GDP has grown thirtyfold in absolute terms—creating, so to speak, more forces of production than those of all previous eras. If we were to compare today to the not-so-distant century of humiliation, such an economic miracle cannot help but instill in Chinese people a particularly strong belief that China’s economic growth will continue indefinitely, and all problems can be solved via economic growth.

In economics, the Kuznets Curve embodies the aforementioned type of thinking, and, what’s more, it also accords with the overall design of the reform process. The Kuznets Curve demonstrates that as a country’s income increases, it appears to follow a developmental arc in which income disparity will first increase, before decreasing later. The curve suggests that all the myriad problems which arise in the course of growth can best be solved by further growth. Chinese economists have been particularly happy to make use of the Kuznets Curve, and they are so enthusiastic that few actually read Kuznets’ original text. Few know, for instance, that within Kuznets’ theory, the decrease of income disparity over the course of a long cycle exists alongside a number of other factors and additional conditions that would be hard for the contemporary Chinese elite to accept.

But even putting all this aside, the deterministic approach to growth that lies behind the Kuznets Curve has already been disproven by Piketty’s Capital in the Twenty-First Century, which illustrates that economic growth in the capitalist era has tended to produce widening income inequality, with the postwar period (up until the 1970s) an exception to the norm. At the time that Kuznets put forward the idea of the Curve, he just happened to be living in the midst of this exceptional era, called the postwar Golden Age.

Marx liked to use the concept of “fetishism” to describe the reversal that takes place in the relationship between people and things, as well as ends and means, within a commodity society. We might then refer to the unquestioning faith in growth mentioned above a sort of “growth fetishism.” Growth in material wealth was originally nothing more than a means by which people could seek a happy life. But today it has instead become a purpose in and of itself, and if the desire for a happy life obstructs economic growth, then it must be forced to yield.

Why Must There Be Growth?

Existing society determines social consciousness. The ultimate cause of “growth fetishism” is not something as simple as historical inertia, then. In modern society, growth is a type of compulsion. It is one of the necessary conditions for the regular operation of society, and this is the real source of “growth fetishism.”

When speaking of the enforcement of growth, many will immediately think of employment.

In the war to keep GDP at 7 or 8 percent, it is said that the main thing being protected is, in fact, employment. Mainstream macroeconomics treats economic growth and employment as inseparably intertwined, using the term “full employment” to refer to economic prosperity. But the crux of the matter is this: the nucleus of the modern economic system’s regular operation—the hiring of labor—is premised on unemployment. Only via unemployment can workers’ attachment to capital be ensured. If one were to completely eliminate unemployment, implementing actual full employment, then the extreme increase in wages would rapidly create a crisis in the basic employment system itself.

Under China’s system of rural-urban division, unemployment is mainly an expression of surplus rural labor.7 This large-scale rural labor surplus has, in fact, been a major reason for the last forty years of economic growth. But in recent years, one of the main issues confronting the Chinese economy has been structural changes occurring within this rural surplus labor pool, causing labor costs to rise. Under such conditions, employment cannot be the main factor in enforcing growth. On the contrary, the creation of unemployment may actually be a huge benefit for economic growth.

The second cause of compulsory growth is accumulation and profit. Within political economy, growth and capitalist accumulation are almost synonymous, with accumulation acting as the fundamental drive behind profit. Society’s wealth is divided into constant capital, variable capital and surplus value. If all of the surplus value were squandered on luxury consumption, then society as a whole would see no growth, but would instead be caught in “simple reproduction.”8 Surplus value can only be advanced via accumulation, which entails the buying and selling of more constant capital and variable capital over a period of time, which is what ultimately causes the economy to grow, taking the form of “expanded reproduction.”

Therefore, in order for surplus value to be used for accumulation, it must first be realized, which is to say that commodities produced must be successfully sold, becoming money. It is at this point, however, that a paradoxical situation arises: because value in the commodity form contains surplus value, it must be exchanged for money via the market for society’s overall purchasing power to increase. But the increase of society’s purchasing power is itself already premised on the market exchange of commodities containing surplus value for money. Therefore, the realization of surplus value is both the cause and the effect of accumulation. The realization of profitable returns on capital relies on capital accumulation. Conversely, if capital cannot accumulate, returns on capital cannot be realized. If profit cannot be realized then naturally accumulation cannot grow further, and this of course will cause difficulties in the realization of profit for other capitals, creating a vicious circle between profit realization and accumulation. This is economic crisis.

If you want to stop this sort of chain reaction, it is necessary to sunder the logic linking accumulation and profit. It is “fortunate” that the Chinese system has provided excellent conditions for capital to reduce its susceptibility to the problems that arise between realization and accumulation. State officials’ performance is assessed on the basis of economic growth, the fiscal system divorces administrative duties from financial power, and the land tenure system divides the city from the countryside. Together, these institutional factors have given rise to a growth-centered model of competition among local governments. But local government investment isn’t that closely tied to profit. When accumulation via private investment encounters difficulties, government investment acts as a shot of adrenaline. In this way, it ultimately assists private capital in the realization of profit, escorting it into the accumulation process. This is the most important lesson drawn from Keynesian economics. But the model of competition used by local governments in China has already exceeded the limits of Keynesianism, because, strictly speaking, it is not a supplementary measure undertaken to increase effective demand at a time of sluggish investment by private capital. Instead, this model has taken center stage within capital accumulation as a whole. If you want to make money, you have to invest according to local government policy.

But this simple decoupling of accumulation from profit often leaves behind surplus production capacity and “zombie enterprises.”9 People often say that state investment protects growth. But sometimes bankruptcy is not without its benefits. After all, isn’t the delivery of profits ultimately just to ensure the maintenance of growth? Or is the protection of growth ultimately to ensure the delivery of profits to capital? When all is said and done, does the visible foot tame the invisible hand, causing capital to serve the people? Or does the invisible hand tame the visible foot, making the people subordinate to capital? This is the question.

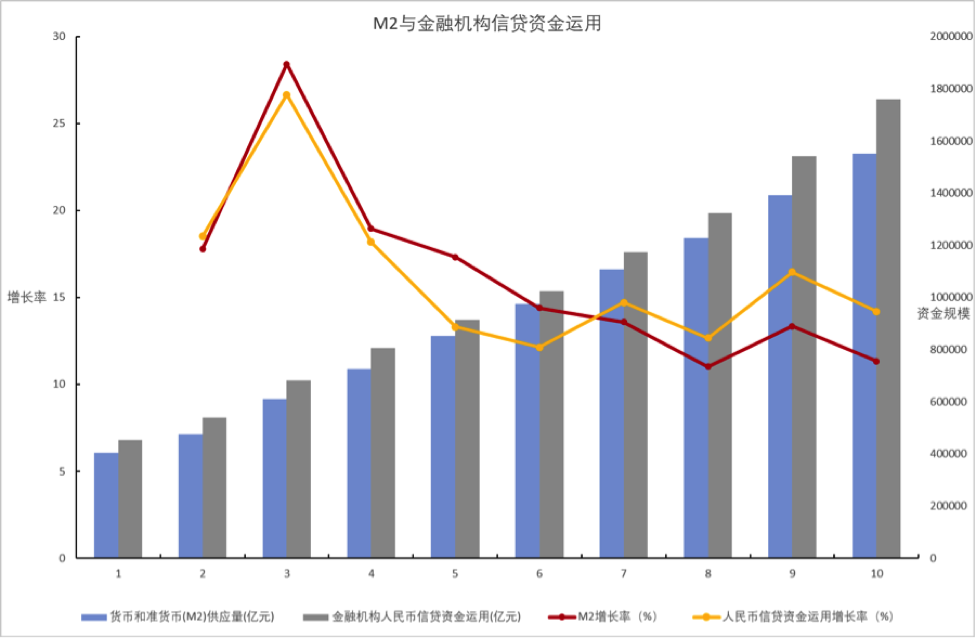

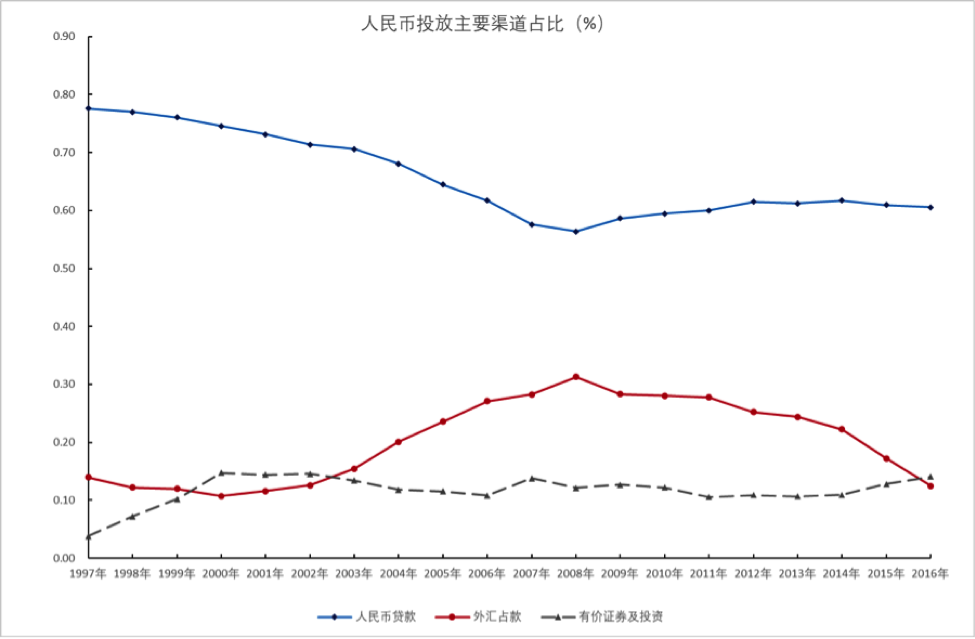

The other cause of compulsory growth is debt. In the modern market economy the significance of debt or credit does not merely lay in its capacity to speed up the accumulation of capital. Instead, it constitutes one of the necessary preconditions for capital accumulation as such. The increase in value that corresponds to the accumulation of capital likewise requires a corresponding increase in money, and bank loans are the primary means by which money is thrown into circulation. According to the theory of endogenous money, within a given economy, money primarily comes from commercial banks putting their assets to productive use. In actuality, the absolute volume as well as the growth rate of financial institutions’ total RMB-denominated funds in circulation are both extremely close to those of the money supply (M2).10 (See Chart I below.) The RMB-denominated funds held by financial institutions in aggregate actually represent all the different means of throwing money into circulation, at various scales and scopes. In our country, RMB loans given out by commercial banks have always been the most important means of investment, accounting for about 60 percent altogether.

[X Axis: It is not clear from the text, or from this figure, what time period is covered by this graph. With ten units, however, it roughly matches the 10-year plot below, so we can tentatively presume the author is using a matching time period here, 1996-2016.

Left Y Label, referring to the line chart, reads: Growth Rate

Right Y Label, referring to the barplot, reads: Scale of Capital, denominated in hundred million RMB.

Line Chart: Red line designates growth rate of M2, yellow Line designates growth rate of RMB-backed credit in circulation.

Barplot: Blue bars designate M2 Money Supply, grey bars designate Financial Institution Credit in Circulation, both denominated in hundred million RMB.]

[Y Axis: Percent of Total

X Axis: Year

Lines: Blue line is “RMB-Denominated Loans,” Red Line is “Funds Outstanding for Foreign Exchange,” and Grey Line is “Securities and Investment”]

Regardless of whether we are speaking of private or state capital, in actuality they are both heavily leveraged. And debt requires repayment with interest, which imposes a strong dampening effect on the rate of profit and the growth rate. Once the economy’s growth rate declines, many enterprises won’t have the capacity to make these payments with interest. This easily triggers a chain-reaction debt crisis, and then this debt crisis leads to a further worsening of the vicious circle between profit and accumulation. The difficulties faced by private business in China today are largely related to the fact that equity pledge finances are nearing their closing position as stock prices fall.11 Up to the end of September 2018, RMB-backed loans reached 131.8 trillion RMB, out of the 197.3 trillion “total social financing” recorded by the People’s Bank of China. If we presume an annual interest rate of 4.75 percent, then the yearly interest burden would be some 6.26 trillion RMB. It may be helpful here to compare this figure to an estimate of the total profits of industrial enterprises nationally. Between January and August of 2018, total national profits were 4.42 trillion. If we multiply by 1.5 to estimate a comparable annual figure, the total national profit comes to 6.63 trillion, almost exactly the same as the annual interest burden. (These figures are not truly of the same caliber and should not be compared as such, they just help give us a very rough idea of the trend.)

The decoupling of profits from local government investment is also accompanied by local government debt at an enormous scale. According to data from the ministry of finance, by the end of 2017 the total government debt was 29.9 trillion, and if we subtract the 13.4 trillion national debt, we are left with 16.5 trillion of local government debt. In addition, according to the Bank of International Settlements, in addition to this 16.5 trillion recorded in official statistics, there is also likely around 8.9 trillion of hidden debt.

Local governments’ investment in infrastructure and the real estate market are inextricably linked via land financing,12 and the real estate industry is, moreover, a major consumer of loans. Up to September of 2018, total real estate loans had reached 37.45 trillion RMB, of which individual mortgages accounted for some 24.88 trillion. Moreover, of this year’s new RMB-denominated loans, real estate ultimately took up some 39.8%, and this does not even include other forms of credit under a different name, or sums of money obtained from different forms of financing. From this, we can see the central position held by real estate in our country’s economy.

The entire supply chain of the real estate economy is almost completely founded on debt. Loans are used not only to buy land but also to sell it13; not only to construct and sell buildings, but also to buy them. From the viewpoint of the overall circuit of value, this implies that all the new money put into circulation by the real estate market far outweighs the new value actually formed, creating a severe imbalance. Even if this much money being thrown into circulation doesn’t create general inflation, it will inevitably lead to asset price inflation. Real estate investment happens to have a particularly strong financial character,14 so the imbalance between new money and new value is ultimately restored to equilibrium when real estate prices depart wildly from their basis in value. Using terms from political economy, this implies that the direct profits of the real estate economy and all its other forms of revenue are based not on the industry hiring workers to create surplus value, but instead on the direct expropriation of homebuyers’ income.

Therefore, real estate and infrastructure investment being treated as the center of economic growth are accompanied by enormous debt, and this debt must be repaid with interest. Debt repayment requires a certain profit rate, which in turn requires a certain rate of economic growth. And often the only way to maintain such a growth rate is the continued reliance on real estate and infrastructure investment.

So who will pay the bill?

Notes from the editors & translators at Chuang

- Original title: 你的就业寒冬,保住了国家的经济增长. Author’s pen name: 江下的老马. Date: 2018年10月25日. URL: http://tootopia.me/article/12463. We’ll be publishing more on the nationwide repression of leftists and related matters over the coming weeks, but for now see “Seeing through Muddied Waters, Part 1: Jasic, Strikes & Unions” and “Let the People Themselves Decide Whether We’re Guilty.”

- These can be found here and here.

- See our interview with Lao Xie, “A State Adequate to the Task.”

- This is the position held by David Harvey, and is similar in form Rosa Luxemburg’s interpretation of Marx.

- According to the People’s Bank of China, the Chinese term 社会融资 usually includes all loans of local and foreign currencies, entrusted loans, trust loans, bank acceptance bills, corporate bonds, equity financing, foreign direct investment and foreign debt. It is intended as a summary measure of all financial flows. See: Qiang Xiaoji, “PBOC plans to redefine total social financing,” China Daily, 10 February 2011. <http://www.chinadaily.com.cn/business/2011-02/10/content_11979368.htm>

- The author mistakenly attributes this quote to Capital Volume 1. In fact, it is from the Communist Manifesto, co-authored with Engels. (Samuel Moore translation.)

- The “urban-rural divide” referenced here is administratively embodied in the hukou(户口)or “household registration” system, which designates one as a “rural” or “urban” resident , with rights allotted according to locality. The hukou has been an essential defining feature of Chinese industrial history, for more on its history, see: “Sorghum & Steel: The Socialist Developmental Regime and The Forging of China,” Chuang, Issue 1, 2016. <https://chuangcn.org/journal/one/sorghum-and-steel/> and for its use in labor management, see both “Gleaning the Welfare Fields” and “No Way Forward, No Way Back” in Chuang, Issue 1, available here: <https://chuangcn.org/journal/one>

- The author here is referring to Marx’s concept of “simple reproduction,” which is a largely conceptual category rather than a real description of steady-state economies, used as a stepping stone in his explanation of properly capitalist reproduction. The author uses it similarly, arguing that just replacing the value already in circulation, even if it entails economic activity to do so, does not necessarily lead to growth as such. True capitalist growth occurs via “expanded reproduction” when surplus value is funneled back into the accumulation process, which the author elaborates in the next sentence.

- The author uses the term 僵尸 (jiangshi) here, which means both “zombie” in the Western sense, but also refers specifically to Chinese Vampires, which absorb the qi of the living. The author is likely referencing the concept of the “zombie corporation” in Western economics literature, but the Chinese term adds depth to the metaphor, portraying such firms as not simply undead but also as entities that feed off the basic life-force of the economy.

- The author here uses terms popular in Modern Monetary Theory and other Post-Keynesian forms of economics, which require brief explanation. “Endogenous Money” refers to the supply of money that, theoretically, derives from the demands of the real economy—the “theory” here being that the overall money supply will move in unison with net real production. “M2” designates one measurement of the overall money supply. M0 is all the cash in circulation, M1 is this cash plus checking accounts and other types of demand deposits, traveller’s checks, etc., while M2 includes both of these plus savings and time deposits.

- The author is here referring to a very specific financial phenomenon in China, using the terminology most often used in mainstream economic reporting. A few definitions of the English terms will be helpful: in finance a “position” is essentially the type of bet an investor makes on an investment, a “long” position would be something like the long-term purchase of a stock with the expectation that it will go up, while a “short” position would be borrowing shares (often from a brokerage firm) and immediately selling them on the market with the expectation that they will lose value, then repurchasing them once the drop has occurred and returning them to the original lender. To “open” a position is simply to initiate this process, resulting in a “holding” position—holding a long position means the investor is currently holding the stock that they expect to appreciate over time, holding a short position means that the investor has already borrowed the stock and sold it, but has not yet rebought it to return to the lender. To “close” a position, then, signals the completion of the process, either the sale of stock held on a long position, or the repurchase and return of stock borrowed on a short position. “Equity Pledge Financing” is another important term, particularly for the Chinese context. Since the bulk of financing is funneled through the large, monopoly banks, which are effectively drawing on the mass of savings to underwrite their loans and which have strong ties with large industrial monopolies, it can be hard for smaller private firms to obtain sufficient credit. Therefore, a large “shadow banking” sector has also arisen alongside the formal financial sector. Much of this “shadow banking” exists in a legal grey area, but the state has recently sought to crack down on it. One popular form of “shadow banking” is the use of “Equity Pledge Financing,” which is where the management or key shareholders of a company will pledge their own stock holdings in exchange for credit. Equity-pledge loans grew rapidly after 2014, and the state has recently sought to crack down on this form of financing. The crackdown, likely combined with the natural maturity period of such loans, has meant that many equity pledge financed positions are nearing their “closing” position—when profit or loss will be realized. This is the phenomenon to which the author is referring. A good summary in English can be found here: Feng Zhu, “Equity pledge financing and the Chinese stock market,” BIS Quarterly Review, December 2018. <https://www.bis.org/publ/qtrpdf/r_qt1812t.html>

- In China, “land financing” is a broad category, but it the practice has been essential to the country’s rapid urbanization. Essentially, it entails a local government leasing out land to some sort of for-profit endeavor. In non-urbanized areas, this is particularly important, since the bulk of land is legally held in common by local residents, administered via local government (such as the “village council”), which has the authority to lease but not sell this land outright. Individual families can do the same for their individual plots. In peri-urban areas, this quickly leads to rapid urbanization, as local governments often engage in initial preparatory “land investment” such as building roads to greenfield sites, and then the private proprietors who hold the new leases engage in construction of fixed capital on the site (i.e. factories, dormitories, or, in the context of real estate speculation, large condo complexes and retail malls). These areas eventually get absorbed into the city, with incomplete absorption resulting in the creation of “urban villages” (城中村) wedged into the center of major cities like Guangzhou. For a full description of the phenomenon, see: Liu Minquan, “Land Financing-led Urbanization in China: Evolution, Scale and Lessons,” Paper written for the United Nations Economic Commission for Africa (UNECA), January 2018. <https://www.uneca.org/sites/default/files/uploaded-documents/SocialDevelopement/hlpd-urbanization-industrialization-2017/uneca-china-land-financing.pdf>

- We asked the author how loans are used to sell land, and he explained: “This refers to the phenomenon of local governments using land that hasn’t been sold yet as collateral for loans.”

- We asked the author what he means by saying that real estate has a stronger financial character than other sectors, and he explained: “The difference between purchasing ordinary commodities and purchasing financial commodities is that the former is aimed at consumption (for subsistence or production) while the later is aimed at obtaining interest, dividends or capital gains. If one purchases housing in order to live in it, then it is an ordinary act of consumption. If it is aimed at leasing out in order to obtain rent, it is a financial investment. If it is aimed at turning around and selling the property at a higher price, then it is financial speculation. It is thus easy to see that real estate possesses features of both ordinary commodities and financial assets.”