Overview: Capital in Competition

The fact remains that capitalism is, in essence, a global system, so the transition to capitalism cannot be explained solely in domestic terms. In this section, we return to developments in the global economy, but now focusing on China’s new role in the international hierarchy of production. Central to this story is the nature of competition as a driving force of capitalism, taking place simultaneously between firms, countries and regional blocs of capital. As long as growth is robust, this competition leaves sufficient room for mutually beneficial alliances across these levels. But when growth slows across the board, the same competition becomes a zero-sum game. In such conditions, the role of national alliances of capital and regional trade blocs, centered on different currencies, takes prominence, and international politics becomes a game of juggling financial bubbles while shrugging the worst crises off onto competitors. Trade wars, currency wars and capital wars in emerging markets become the defining features of the economy.

It is in this context that capital as a global system is able to shift its center of gravity. We’ve already seen how the pivot to the Pacific took place through the Cold War alliance between the US and Japan. This shift was, in historical terms, relatively smooth due to the clear hegemony of the US, the demilitarization of Japan, and the ready availability of military procurement contracts justified by the threat of socialism. But toward the end of the century, greater head-on competition between US and Japanese manufacturers would lead to an all-out trade war, ending in Japan’s defeat. Ironically, however, the Japanese crisis, paired with the end of the Cold War, would lead to the conditions in which a new bloc of Sinosphere capital could ascend to the helm of the region. The trade wars continued in the absence of Cold War military contracts, and mainland China rapidly outcompeted Southeast Asian manufacturers in their jostling for greater shares of global supply chains, now assisted by a flood of overseas Chinese capital back into the rapidly liberalizing market via the intermediaries of Hong Kong, Singapore and Taiwan.

All of these changes exerted a powerful gravity on Chinese urbanization and industrial geography. A new form of city began to arise in the key coastal export zones, sprawling, inhuman and constantly re-developed, the earliest incarnation of the delta megacities of today. These new cities were spaces of dispossession, the natural environment of the proletariat. It is no coincidence, then, that the bottom of the capitalist class system took shape here first, as migrants flooded into places like the Pearl River Delta looking for work. But where these migrants came from, why they migrated, and why other forms of industrial employment had become foreclosed to them will all be explored in Part IV, where we explain the rise of the domestic capitalist class system.

Early Trade and Investment

International trade had never composed a large share of Chinese production in the socialist developmental regime, and much of what did exist was with other socialist countries. The bulk of this had been with the USSR, accounting for almost fifty percent of China’s trade between 1952 and 1960 and the major source for an entire range of capital goods, from basic industrial materials to machinery. The revival of industry in Manchuria and the First Five-Year Plan (1953-1957) that followed would have both been impossible without this Soviet support. In exchange, China had exported labor-intensive goods such as textiles and processed foods into the Soviet Union. But even at its height, the trade to GDP ratio never exceeded ten percent. As the Great Leap Forward failed and Sino-Soviet relations began to strain, trade between the two largest countries in the socialist bloc stagnated. Between 1959 and 1970, Chinese trade saw no net growth. By 1970, trade with the USSR had almost entirely dried up, dropping from half of total trade to a miniscule one percent. The effect on the overall trade to GDP ratio was stark, with trade’s share dropping to a mere five percent.[1]

If future development were to occur, China would require a new source for the advanced capital goods that it was not able to produce domestically. This provided the context in which China had approached the question of a diplomatic rapprochement with the US, itself beginning to feel the stir of industrial crisis. Equally important, however, were the regional economic deals that followed from this reconciliation with the military superpower of the Pacific Rim. In step with the US, Japan had normalized diplomatic relations with mainland China in 1972. This was followed by a series of trade agreements over the course of the 1970s, the most important of which was the Long Term Trade Agreement of 1978, aimed at solving the capital goods problem in China by exporting natural resources (namely oil and coal) to resource-poor Japan in exchange for the import of entire industrial plants, including all relevant technology and construction materials. This agreement coincided with the beginning of the crisis of overproduction among Japanese manufacturers, providing an essential market for capital goods that could no longer be profitably put to use in the domestic economy. By 1980, “China was relying on Japan for the largest share of its imports,” with Japan composing 26.4 percent of the total. In the same year, Japan was the market for 20.1 percent of Chinese exports, mostly in natural resources. Meanwhile, the bulk of imports were in precisely the capital goods that had begun to experience the most severe profitability declines, including “Heavy Chemical & Industrial Products” and “Machinery & Equipment.”[2]

Beginning in the 1970s, then, Chinese trade began to crawl back up from its trough, regaining its socialist-era peak of 10 percent of GDP in 1978 and then climbing steadily throughout the first half of the1980s, with imports and exports arranged via bilateral trade agreements providing roughly equal shares in total trade.[3] During this period, the domestic economy was still thoroughly insulated from the capitalist market by a “double air lock” in which the state monopolized foreign trade, allowing only twelve nationalized trade companies to facilitate the relationships laid out in the trade agreements. Meanwhile, the value of the Chinese yuan was completely severed from international currency markets, being set at a planned rate, making it unconvertible. Dual prices therefore existed for internationally traded goods and a dual-track currency system was instituted, with the yuan untradeable on the global market and special market-rate foreign exchange certificates issued in its place.[4]

This system, however, was entirely dependent on a steady stream of oil and coal. Production at Daqing Oil Field, the largest in China (and among the largest in the world) had been accompanied by new output from a string of smaller fields opened throughout the Cultural Revolution, leading to a rapid 20 percent annual growth rate in total petroleum output between 1969 and 1977. Growth was so rapid that “planners were stating that China would approach Saudi Arabia’s position as the world’s third largest petroleum producer” by 1985.[5] The Ten Year Plan of 1976-1985 (the first formulated by Deng Xiaoping’s leadership) was founded on a series of mega-projects, built with imports of industrial goods (including entire plants) from the capitalist world paid for in oil. The gargantuan size of the plan was made possible by the presumption that oil output would continue to grow at the same rapid rate, despite the fact that the reserves presumed to exist had not actually been verified. In the end, the reserves never materialized, overexploitation in the early 1970s had caused lasting damage to long-term productivity, and petroleum production peaked at the very beginning of the Ten Year Plan, right as many of the trade agreements were being signed.[6]

The result was the growth of a massive deficit between revenues and the amount of future foreign reserve obligations.[7] Many contracts were ultimately cancelled, but the situation also encouraged the reform of both commodity and currency airlocks insulating the Chinese economy from global market prices. If these airlocks could be carefully worked around, it would allow for new means of paying for necessary development outlays—in particular the expensive plant and equipment being imported from Japan. By the mid-1980s, the yuan was intentionally devalued, beginning to bring it in line with global currency markets (though it remained at a state-set exchange rate), and by the early 1990s the dual-track currency system had been entirely abolished.[8] Meanwhile, the passage of the Plaza Accord in 1985 saw rapid inflation in the yen, while the dollar (as well as many Southeast Asian currencies that were pegged to it) became more competitive. The newly devalued yuan was well positioned to begin competing with the dollar-pegged currencies of Southeast Asia for a position within the lower rungs of the Pacific Rim hierarchy.

The rise of labor-intensive production hubs in rural areas (particularly in the key river deltas) had already positioned the mainland to benefit from increased demand for light industrial goods. The productive capacity of the TVEs was evident, and the domestic market had begun to shift from persistent shortage to surplus. A building crisis of overproduction meant that any TVEs able to find new markets would not only be saved from bankruptcy, but also catapulted far ahead of their competitors. The second airlock insulating the domestic economy was therefore overcome through the establishment of the Special Economic Zones (SEZs), the first of which were all in relatively poor coastal stretches in Guangdong and Fujian provinces, near Hong Kong and Taiwan. This was accompanied by a massive increase in the number of companies allowed to engage in foreign trade, many of which were located in the SEZs, which allowed duty-free imports on the condition that they were used within the zone for the production of goods for export.[9] The result was that by 1987, “China had established what were, in essence, two separate trading regimes,” one of which was fully marketized and geared toward export and the other a partially-reformed, more heavily regulated “ordinary trade” regime.[10] The nature of exports also changed in this period. While petroleum had still been the largest export product in 1985, composing some 20 percent of the total, “by 1995 all of China’s top export commodities were labor-intensive manufactured goods.”[11]

This boom was spurred by both the rapid growth in the domestic economy and a large influx of Foreign Direct Investment (FDI). While very few (2.6 percent of the total in 1980) of the mainland’s early imports originated in Hong Kong and Macao, these areas would act as a key interface between the rapidly changing developmental regime and the capitalist sphere into which it was slowly being incorporated. Hong Kong and Macao soon came to dominate China’s share of inbound foreign investment, providing 51.6 percent of all FDI by 1983, followed by Japan at 20.4 percent and the US at 9.1 percent.[12] Some of this was due to the illicit recycling of mainland capital and the unrecorded funneling of Taiwanese investment through Hong Kong financial markets, but the role of Hong Kong itself cannot be exaggerated. Even prior to the founding of the SEZs (the most important of which was in neighboring Shenzhen, directly across the border), Hong Kong firms had been allowed to sign export-processing contracts with Chinese firms (CBEs and TVEs) in the Pearl River Delta (PRD).[13]

This was the beginning of Hong Kong’s own deindustrialization, as both local firms and international subcontractors for Japanese corporations operating in the territory shifted their manufacturing capacities across the border to the PRD. Never the beneficiary of the heavy-industrial military contracts awarded to Japan and South Korea, Hong Kong’s manufacturing sector was largely composed of smaller, light industrial workshops. These plants were relatively cheap to move, and their decentralized nature, with laborers dispersed and disciplined as much by traditional family hierarchies as by simple wage exploitation, helped to prevent the type of militant workers’ movement that would form in the industrial zones of South Korea. When they offshored, these firms left their administrative, financial and marketing components in Hong Kong, with upper management still able to make the short commute across the border when necessary. Early on, Hong Kong also provided raw materials, components and blueprints, in what was known as the “three supplies, one compensation” (三来一补) system. The “one compensation” was a lump sum payment given from the Hong Kong firm to the local contractor, paid in installments of American or Hong Kong dollars. This payment went directly to the local bureaucrats, cadres and managers who had secured the contract. The workers themselves were paid in yuan on a piecework basis, with the remainder of the foreign currency often liquidated on the black market for a high exchange rate or laundered via Hong Kong banks for reinvestment.[14]

Similarly, goods produced in the PRD were often not shipped directly out of mainland ports to their end markets, but were instead funneled through the duty-free Port of Hong Kong, helping to make it the busiest container port in the world between 1987 and 1989, then again in 1992 to 1997.[15] The ultimate result was “one of the most rapid de-industrializations in any contemporary society.”[16] This process began with the opening of Chinese trade to Hong Kong industries in the last years of the 1970s, accelerated with the founding of the SEZs, and then skyrocketed with the global trade shifts associated with the signing of the Plaza Accord—itself a result of a low-level trade war between the US and Japan. Hong Kong’s manufacturing workforce fell in both absolute and relative terms, from “892,000 workers in 1980, [it] shrank to about 327,000 workers in 1996,” and “from about 47% [of the total labor force] in 1971, to only 14% in 1996.”[17] Tertiary industry grew in its place, Hong Kong regaining its status as a key entrepôt for global trade and gaining a new role as one of the region’s financial hubs. By 1996, “over 40 percent of Hong Kong’s GDP derived from finance and banking, trade and transport service.”[18] On the mainland, this meant that the early reliance on Japanese capital goods was now superseded by global regimes of trade and finance administered via the (now-former) colony.

Urban Behemoth

Capitalist production takes on its fullest, objective form at the scale of society itself. People’s ways of living and working change, their patterns of movement are attuned to the flow of value, the non-human environment is gutted, settled, abandoned and reconstituted as a space for recreation or “ecological services” and human population concentrates alongside capital, knit together by a growing technosphere of roadways and swirling satellites. But the cities of the East Asian mainland have long memories. Old regimes of production are chiseled into their foundations, the chaos of collapsed polities ground into mortar for the new. As in Europe, the initial subsumption of the East Asian mainland into capitalist production would inherit an established network of distinctly non-capitalist urban agglomerations, themselves shaped and reshaped by hundreds of years of warfare and economic transformation. The first, halted stage of transition in the late Qing and Republican years saw the rapid growth of older coastal and river port cities capable of operating as entrepôts connecting the continent’s massive agricultural sea to the global market. Shanghai, Guangzhou, Wuhan, Nanjing and a few other ancient cities benefited from this process, growing at the expense of their landlocked counterparts. A number of new urban concentrations also arose in the same period, Qingdao being a representative case, and the late stages of this early transition, carried out under Japanese occupation, would see rapid colonial urbanization in Manchuria as well as wartime development of some interior cities, such as Chongqing.

The socialist developmental regime both halted this process of urbanization and hardened the divide between urban and rural spheres. Rates of urbanization had long been lower in the East Asian mainland than in pre-capitalist Europe, and rural population density was generally much higher. Both characteristics were ultimately carried over into the socialist era. But the developmental regime also anchored population to localities in unprecedented ways. The hukou system formalized the urban-rural divide while also making migration across equivalent localities into a bureaucratic hurdle. Intra-rural migration in the period was likely lower than the already low levels experienced in the era of the pre-capitalist dynasties. In the cities, the danwei tied subsistence to the enterprise, and labor turnover throughout the socialist era was incredibly low. This had the effect of not only limiting intra-urban migration, but also balkanizing the cities themselves. Each enterprise became increasingly autarkic, providing housing, food and entertainment for its own workers. The region’s ancient cities had long cycled through relatively closed and open periods, defined on one extreme by the ward system of the Tang, when freedom of movement was carefully curtailed, and on the other by the open cities of the Song or early capitalist era, when freedom of movement was essential to increasingly marketized production. Though the socialist era city did not explicitly curtail urbanites’ movement within the city, the enterprise acted as a sort of informal ward system, since members of a given enterprise tended to live, eat and partake in leisure activities within the same spaces, many of which were physically demarcated with systems of walls, gates and courtyards.

This balkanization began to break down in the southern coastal cities first, since these were the areas with the lowest concentrations of large state-owned enterprises and the longest histories of small-scale production. As early as the 1960s, cities like Shanghai and Guangzhou already saw the emergence of proto-proletarians not well-defined by either danwei or hukou. As “worker-peasants,” some within this class were actually residents of neighboring rural areas who would be shipped into the city during down seasons in agricultural production. Others, known as “lane labor” (里弄工), were simply the poorly-incorporated segment of urbanites (mostly female) who had no strong connection to a given enterprise and therefore could be recruited from the lanes and alleyways between the large enterprise complexes. The very ability of these workers to traverse the boundaries of the socialist city was the reason they were attractive sources of labor for local enterprises. When “worker peasants” finished a contract, they could be sent back to the countryside. They got a boost in income, urban administrators did not have to provide outlays for their subsistence and industrial enterprises could obtain abundant low-cost inputs for production. Similarly, “lane labor” could be used to cheapen reproductive costs for workers higher in the urban hierarchy, with women and unemployed youth recruited to do laundry, prepare food and produce and repair clothing for workers in the large industrial enterprises. Meanwhile, the enterprise did not have to provide the full danwei benefits to such workers, instead offering wages or an array of more limited benefits.

As urban industry was reformed, this proto-proletariat would grow in size, labor turnover would increase, and the balkanization of the socialist city would give way to rapid urban growth fed by probably the largest mass migration in human history. At the same time, rural industrialization, driven by the new domestic market, would see the emergence of a sprawling new urban geography—first in the river delta cities, where old urban agglomerations would expand to meet newly urbanized “towns,” and later in the growth of entirely new, properly urban concentrations out of smaller cities and market towns in what had once been exclusively agricultural areas. If the large SOE complex defined the urban structure of the socialist era, it was the rise of the TVE and, later, the fully private firm that would define the expansive urban geography of China’s entry into capitalism. The size and scale of this process also ensured that these new capitalist cities would take on gargantuan proportions befitting the global market they served. Between 1978 and 1990, the number of cities in China more than doubled, from a mere 193 to some 467, and the number of cities with a population greater than one million grew from thirteen to thirty-one.[19]

Though it’s helpful to think about the accumulation of value on an abstract level, in order to identify its core laws of motion, these laws nonetheless operate objectively, shaping both space and society. The fall of the rate of profit is an abstracted description of a very wide aggregate of investment decisions made by individual firms operating on a market that has reached a certain level of saturation. But its objective form is both social and spatial. At the social level, the cycle of boom and bust ultimately generates new modes of living, new cultural practices, and new waves of unrest and reaction. At the spatial level, crisis is embodied in the senescence of old industrial cores, accompanied by a fierce global competition to take their place at the cutting edge of global production. Across the rustbelts, obsolete factories are shuttered, profitable investment concentrates on a few remaining firms, and infrastructure decays. Alongside this, unemployment and out-migration both tend to increase, the black market grows and unrest may become more common, but in general the area undergoes a drawn-out decline through attrition.

Many cities compete to helm key segments of the new industrial structure, but the outcome is often determined by structural factors and historical inertia, with the whims of the ruling class also contributing a small but not insignificant influence. In the last wave of global industrial restructuring, for example, a location along the Pacific Rim coastline was among the most valuable endowments a city could have—coastal development a factor of expanding global trade, and Pacific urbanization generating a feedback effect whereby the changing center of gravity of accumulation conditioned new urban development, and this new urban development brought with it a wave of new infrastructural investment that further reinforced the eastward tilt of capital. At the same time, the scale of the new industrial structure is always larger than its predecessor, due to the drive for compounding growth that sits at the core of the capitalist economic system. But, though its sheer mass may increase, production itself tends to shed labor relative to capital, and short of major waves of destruction (such as those wrought by the world wars), newly revolutionized industries will on average directly employ smaller and smaller shares of the population compared to the cutting-edge facilities of the last industrial revolution. The pool of new employment in the most productive industries, over which firms and cities compete, then, tends to shrink in relative terms, and a larger share of employment in general is exposed to greater pressure to cheapen labor costs. In each wave of industrial restructuring, the rustbelts become more numerous and the sunbelts either more exclusive or more exploitative, with greater numbers of cities suspended somewhere in between. Direct dependency on the core industries also decreases, with more urban areas dependent on the indirect maintenance of productive hubs located elsewhere.

As we have already seen, this competition is also international in scale, with the success of the Chinese sunbelt cities built on the inability of competitors in Southeast Asian manufacturing to secure more of the global market. Global trends in profitability also clearly structure the new production hubs, with falling profitability not only spurring increased foreign trade, but specifically doing so in pursuit of a cheap, underutilized workforce that can be briefly super-exploited relative to the average cost of labor. While the spread of the American rustbelt, for example, was accompanied by the rise of both a cheap-labor sunbelt (across the southern states) and the ascendance of a series of coastal cities founded on high-tech industries and producer services, the Chinese sunbelt—defined by the most rapid rates of urbanization and economic output—would also be largely coastal, but was defined from the start by its concentration of labor-intensive industries tied to global logistics networks. This was the character of the sunbelt in the period we review here, prior to the rise of China’s high-tech hubs and the ascent of Shanghai, Guangzhou and Beijing as true “global cities” comparable to Tokyo or Los Angeles.

If any single area was particularly representative of Chinese urbanization in this period, it would likely be the Pearl River Delta (PRD), and specifically the area in and around Shenzhen, the most successful of the first four SEZs established in 1980. Urban development in the PRD is symbolic of all the larger trends detailed above. Like Chinese capitalist industrialization more generally, it began not in the established city (nearby Guangzhou), but instead in the rural downriver portion of the delta. Similarly, its industrial composition was defined by the demands of the global economy, even while it was coordinated via extremely local networks of family, village and regional identity. Production was founded on a pool of super-exploited migrant labor, drawn from the countryside and employed in labor-intensive industries for long hours at extremely low wages (compared to global and regional averages). These industries developed alongside a boom in the construction of basic logistics infrastructure, linking new firms directly to the global market via the Port of Hong Kong (and, soon, a string of ports on the mainland side). The ultimate result of all this was the creation of one the world’s largest urban agglomerations, incorporating massive swaths of undeveloped rural land, encompassing several ancient cities and townships and sprawling out in ever-changing patterns of production, settlement and redevelopment that not only embody rapid Chinese economic development but also arc toward a certain ideal of capitalist urbanization itself.[20]

Sky without a Moon

In 1980, when Shenzhen was declared one of China’s first four SEZs, it was little more than a small market town encircled by agricultural land. Its population was somewhere around thirty thousand, including many who worked on nearby farms. Neither the market town nor the agricultural periphery had fared particularly well under the developmental regime, which funneled industrial investment into larger cities at the expense of smaller ones and emphasized grain production even in regions better suited to different crops. By the advent of the reform era, the entire region had become severely underdeveloped.[21] But it also stood at the interface between booming capitalist Hong Kong and the mainland, and the area around Guangzhou had boasted some of the most active popular support for reform early on—often carefully cultivated by Zhao Ziyang (Premier from 1980 to 1987) in his time as Guangdong’s Party Secretary. Opening the area up for experimentation therefore had few downsides, while both its location and recent history added to the potential for successful reform.

Even prior to the development of export industries, South China more broadly (particularly Guangdong and Fujian) had utilized its climatic and historical endowments to become one of the fastest-growing centers of commercial production in the early years of reform. The tropical and sub-tropical climate accommodated a more diverse agricultural output than most parts of the north, and the old commercial networks that had once tied the region together began to reemerge alongside the growth of the rural market. Before the socialist era, the region had dominated in production of fish, silk, sugar, tropical fruits and vegetables, alongside its capacity for rice cultivation. During the earlier transition to capitalism, stalled by the outbreak of war and revolution, the industrial output of South China had been closely linked to these endowments. Light industry was central, including food processing, textiles and the production of basic consumer goods. When the market reemerged in the countryside, the same industries were well positioned for a revival.[22]

South China as a whole “received 42 percent of all realized foreign capital investment” in the years between 1979 to 1994, and, by 1995, it contributed “over 47 percent of the total export output generated by the whole nation.”[23] Throughout this period, the Pearl River Delta acted as probably the single most important core of production in the region. The Delta area alone contributed some 17.34 percent of national export output in 1990, and received 18.95 percent of realized foreign investment. By that same year, it had already grown to dominance within the provincial economy, producing 68.8 percent of Guangdong’s gross value of industrial and agricultural output.[24] Nor was this the peak of its influence: by 2000, “Guangdong province accounted for 42 percent of all China’s exports” and 90 percent “came from eight cities in the Pearl River Delta, led by Shenzhen.”[25] Shenzhen itself became the fastest growing city in the world, its GDP growth rate averaging just over 30 percent between 1980 and 2000. By 2010, it had gone from a fishing town of thirty thousand to a massive city of some 10.4 million.[26] Trends in population growth and urban development matched these numbers. From a meager urban growth rate of 0.75 percent between 1957 and 1978 (in the “Inner Delta,” excluding Shenzhen, not yet a city; and Guangzhou, the largest city with strict migration restrictions), the delta’s urban population (in fully “built-up” areas) grew by 7.21 percent between 1982 and 1990 (numbers that include urbanizing Shenzhen and Guangzhou once migration restrictions were removed).[27]

Much of this growth was driven by the influx of “temporary” migrant workers from the greater region as well as inland China. In the early 1980s, migration restrictions were relaxed, and by 1984 migrants from the countryside were formally allowed to travel to a number of specially designated towns to do non-agricultural work. By 1985, not only could peasants work in designated towns, but they could also freely move to any nearby township to do certain types of work (construction, retail and transport). Siphoning off surplus rural labor, such policies began to rapidly increase the proto-proletariat population across China. But the phenomenon was most pronounced in the South, especially within the PRD. Early on, this phenomenon was largely provincial. In the 1980s, the share of migrants coming from outside Guangdong remained relatively low, having grown from nothing to a mere 11 percent of total migrants in 1988. This population would grow much more rapidly in the 1990s, but, prior to this, migration into the PRD was dominated by an influx of surplus rural laborers drawn from the surrounding region. Compared to the small share of long-distance temporaries, some 88 percent of total migrants in 1988 originated in Guangdong, the bulk of these being short distance migrants from rural areas within or adjacent to the PRD. The vast majority of these first-generation migrants were unmarried young women doing factory work. This “temporary” population grew at an annual average rate of just under 30 percent for the province as a whole between 1982 and 1990, but within the Delta region it averaged more than 40 percent. In 1982, the PRD had contained some 37.25 percent of the province’s total population of temporaries, only slightly above its share of total provincial population. But by 1990, just under 80 percent (almost 3 million) of all temporaries in Guangdong lived and worked in the PRD.[28]

Shenzhen, Dongguan, Bao’an and Guangzhou led these trends, altogether containing more than half of the total temporary population in the Delta as a whole, each with between 15 and 18 percent.[29] Not surprisingly, these were also the areas with the highest per capita output value in 1990 and some of the fastest growth rates in output value over the course of the 1980s. Though the established city of Guangzhou would remain the largest single contributor to the region’s output, its share of the total was halved from 44 percent in 1980 to 22 percent in 1990, while Shenzhen’s grew from a mere 0.39 percent to 12.44 percent over the same period, followed by slightly weaker growth in most of the delta’s other established towns.[30] The ultimate effect was an almost perfect case study of what has been called “urbanization from below,” driven by the transformation of small towns and rural areas into properly urban agglomerations. But in the interim between the PRD’s largely rural origin and the formation of a genuine mega-city around 2010, migration into built-up urban areas only composed some 26.6 percent of all migration within the region (between 1980 and 1990). Instead of immediate urbanization, then, migration to small towns (71 percent of all migration) dominated in the first decade of reform.[31]

The cities that resulted were defined by what scholars and locals began to call “rural-urban integration” (城乡一体化), marked by growing sprawl and intensive industrialization and agriculture.[32] Overall, however, cultivated land “diminished from 2.58 million acres [10,440 square kilometers] in 1980 to 2.25 million acres in 1990,” while the built-up area of designated towns (not including areas designated as cities, where growth was limited) increased at an average annual rate of 23.98 percent over the same years, adding some 67 square kilometers of urban space per year for the entire decade.[33] Industry was similarly sprawling and diverse, dominated by small workshops of less than 200 workers on average, many employing as few as a dozen. In these years, there were simply no major plants (outside the remaining SOEs in Guangzhou) or even substantial factory agglomerations. Old commune dining halls were converted into light industrial workshops, followed by newly constructed buildings no more than two or three stories high with a handful of large rooms. Locals soon began describing the new geography of production with a phrase as poetic as it was accurate: “a spread of numerous stars in the sky without a large shining moon in the center” (满天星斗缺少一轮明月).[34]

The Bamboo Network

The growing financial prominence of Hong Kong in this period was not simply a factor of geographical proximity. Direct family connections and indirect cultural influence were equally important, with much of the early development in the PRD facilitated by extended family networks, communication between the production and administrative wings of the firm taking place in Cantonese, and the predominantly female labor force disciplined by clan or place-based loyalties. Many of these continuities were long-standing features of Southern Chinese history, but just as many were the result of much more recent events. Of particular importance was the influx of Nationalist-aligned refugees into Hong Kong as the war ended and mainland industry was restructured in the early years of the developmental regime. Paired with the territory’s status as a British colony, this concentrated a large, cheap labor force alongside a mass of capital smuggled from the mainland by the wealthier of these refugees, who also had managerial expertise and international connections. Particularly important was the mass relocation of Shanghai businessmen in the late 1940s, bringing start-up capital and extensive knowledge of light industry to the territory at precisely the time when its prominence as an entrepôt had been strangled by the revolution on the mainland. This combination of capital and cheap labor worked to rapidly industrialize the colony over the next two decades. Then, when mainland trade opened again, the same factors would drive two decades of rapid deindustrialization.[35]

But the émigré capitalists in Hong Kong (and Taiwan) were only one fraction of a much larger Chinese capital network extending across Southeast Asia and the Pacific more generally.[36] Often called the “bamboo network,” the roots of this concentration of overseas Chinese capital can be found the period of Ming and Qing regional hegemony that preceded the imperialist expansion of Europe and Japan. During the Ming, Zheng He’s diplomatic missions (between 1405 and 1433) established rudimentary trade networks across the South China Sea and Indian Ocean, often helmed by Cantonese and Hokkien traders. A larger wave of migrants into the region followed the rise of the Qing, as Ming-loyalist armies fought the new dynasty from a series of southern holdouts that were slowly overrun throughout the latter half of the 17th century. These migrants, speaking southern Chinese dialects, filtered into Southeast Asia, in some places slowly incorporating into local economic and political regimes in places like Thailand, and in other areas founding their own polities, such as the Lanfang Republic in Western Borneo. By the middle of the 17th century, Chinese settlers in Taiwan and Southeast Asia numbered more than a hundred thousand.[37] Everywhere these migrants went, they continued the tradition established in the Ming Era, founding their own (usually family-based) conglomerates to facilitate trade, mining, agriculture and light industry across Southeast Asia.

With the rise of Western (and then Japanese) colonialism and the slow collapse of the Qing under foreign pressure and internal revolt, the character of this diaspora network again began to shift. Many Southeast Asian polities (including the Lanfang Republic) fell to European imperial expansion, later replaced by the US and Japan. The Chinese economic networks in these areas were, however, often preserved and sometimes even given preferential status by colonial administrators. A third wave of migrants flooded out of war-torn Southern China following the Taiping Rebellion in the mid-19th century, at which point Chinese migrants in Southeast Asia already numbered over a million, with two million Chinese in Taiwan slowly displacing the indigenous population to become the island’s majority.[38] Some of this new wave of migrants again filtered into Southeast Asia, but many were now drawn to new labor markets in the Americas and Australasia, where they staffed booms in mining and railroad expansion. Though the largest of these countries later expelled many migrants, the diaspora left a lasting influence, with substantial local business networks forming in Pacific Rim cities like San Francisco and Lima. During the late Qing years, Sun Yat-sen famously toured overseas Chinese settlements in order to raise funds for the Revolutionary Alliance—signaling both the cultural continuities of these networks and their relatively high level of dormant capital.

As unrest continued after the fall of the Qing and into the Republican period, a final surge of southern migrants moved into Southeast Asia (particularly Malaysia and Singapore) and then, after the victory of the communists, into Taiwan and Hong Kong.[39] Again, these diaspora populations would become central pillars of local trade and industrial networks, sometimes facilitated by colonial powers and often creating local ethnic inequalities that led to violent confrontations, in some cases culminating in anti-Chinese riots and pogroms: particularly in Indonesia (1965-1966 and 1998), Malaysia (1969) and Burma (1967), causing new waves of intra-regional migration. Such events were one factor, for instance, in the formation of an independent, Chinese-dominated Singapore. In other cases, the Chinese business class underwent a greater degree of assimilation, as in Thailand and, to a lesser extent, the Philippines. But in all instances, the bamboo network retained substantial control over trade ties and large stocks of sitting capital, ultimately capable of contributing to the formation of the Pacific Rim region at a scale comparable to that of Japan, and playing an absolutely central role in the ascent of China within the global economy.

Throughout the late Qing and Republican periods, investment from this bamboo network back into China was minimal compared to the value of labor remittances. Investment from overseas Chinese is estimated to have been $128.74 million (in 1937 dollars) between the late 19th century and 1949, with some eighty percent of this investment concentrated in Guangdong and Fujian. By contrast, remittances amounted to some $3.5 billion (also in 1937 dollars) during roughly the same period.[40] During the socialist era, when remittances could not be sent directly to the mainland, Hong Kong became an essential financial intermediary between the overseas Chinese population and their relatives in China. As ethnic tensions accompanied decolonization across Southeast Asia, Hong Kong (alongside Singapore) also became an important repository for bamboo network capital. Between 1949 and 1990 “some HK$ 73bn. was invested into Hong Kong by the Chinese from Southeast Asia,” an amount that exceeded both US and Japanese investment over the same period.[41]

The concurrent boom in several Southeast Asian countries (namely Thailand, Malaysia, Indonesia and, to a lesser extent, the Philippines) also tended to benefit local Chinese conglomerates. Indonesia is a notable example. Following the fall of Sukarno and the anti-communist genocide in 1965, Suharto’s New Order regime instituted a military-backed developmental program aimed at reconstructing the country’s decaying colonial-era infrastructure, revolutionizing agricultural productivity and drawing in foreign capital. As in China in the same period, the major initial attraction for foreign capital was access to oil and other raw materials. Resource-poor Japan again played a leading role there, reviving trade relationships originally established as part of the Co-Prosperity Sphere. Chinese cukong (主公—a Hokkien term) capitalists played an essential role in this process of internationalization. First, they were able to draw on pools of sitting capital in Hong Kong, Taiwan and elsewhere to funnel into domestic production. Second, they were considered reliable partners by non-Chinese foreign capitalists, who saw the cukong firms as the only domestic forces with “the necessary corporate, capital and distribution apparatus in place, and the business ‘culture’ essential to the making of profits.”[42] These same factors gave them preferential status among the country’s military leaders, who offered monopoly contracts, cheap credit and lucrative deals with state-owned enterprises.

Locally, this generated deep-seated inequalities between Chinese and indigenous capitalists, as well as a more general ethnically-coded inequality experienced by poor Indonesians in their interactions with Chinese shop-owners or in working for Chinese conglomerates. Though the exact weight of Chinese capital in the New Order economy has long been debated, it’s clear that cukong firms dominated production, especially outside of the large state-owned infrastructure projects. By the mid-1980s, a common estimate was that “the Chinese own, at the very least, 70%-75% of private domestic capital and Chinese business groups continue to dominate medium and large-scale corporate capital.” This also meant that, aside from Suharto’s family network and those tied to the top-ranking generals, Indonesia’s New Order “domestic capitalist class remain[ed] predominantly Chinese.”[43]

But equally important is the fact that this domestic capitalist class was often subcontracting for Japanese firms, or at least funded by the more developed Tiger economies that owed much of their ascent to an earlier influx of Japanese capital. Thus, the post-crisis outflow of Japanese capital, facilitated by US military interests, ultimately began to reinvigorate the business relationships of the bamboo network, which grew to global prominence only in the last thirty years of the 20th century. By 1991, the World Bank estimated the combined output of overseas Chinese totaled $400 billion USD, growing to $600 billion in 1996.[44] Though much of this was held domestically, it also tended to be more mobile than funds held by non-Chinese domestic capitalists. It is therefore useful to compare the figure to other sources of investment in the region, though much redundancy exists in these figures: total Japanese FDI worldwide between 1951 and 1986 amounted to some $106 billion, the Asian portion of which was $21.8 billion.[45] This increased rapidly after 1986, “with an annual outflow amounting to $48 billion,” and Japan’s manufacturing investment in Asia for the handful of years between 1986 and 1989 (at the height of the bubble) exceeding the total investment for the entire 1951-1985 period.[46] Ultimately, the picture is one of growing parity between these two deeply intertwined sources of capital, followed a slow shift of gravity within the Pacific Rim from Japan to China via the revival of dormant ties with the bamboo network. The rapid growth of the network was itself driven by the bubbling of the Japanese economy. It then flourished across the region as the bubble gave way to the Lost Decades and Japanese investment went into a relative decline.

The Pacific Trade Wars

By the last decades of the 20th century, global capital had decisively shifted east. US international trade across the Pacific overtook the volume of comparable trade across the Atlantic as early as 1980, and the Asian Pacific Rim economies grew at an annual rate of 5 percent between 1982 and 1985, compared to 1.8 percent in Europe during the same year.[47] On the one hand, this was driven by the Japanese bubble, which drove capital overseas at unprecedented speed. Japan’s share of global FDI reached 17.8 percent in 1984, exceeding that of the US.[48] On the other hand, it was facilitated by continual demand in the US for light industrial goods and raw materials from overseas. This new center of gravity for capital can therefore be understood as a sort of tripod perched between Japan, the US and a growing Sinosphere archipelago of wealth that would, by the 21st century, converge toward the mainland. At roughly the same time, investment also began to funnel into the booming economies of Southeast Asia.

At the top, this process was defined by growing trade tensions between the US and its two top “late developer” competitors: Japan and West Germany. In the Pacific, this resulted in a building trade war, marked by substantial tariffs imposed by the US on Japanese electronics, the use of diplomatic force to restrict Japanese auto, steel and machinery exports, and a number of high-profile cases of scare-mongering and federal blockage of inbound investment projects. Indiana steelworkers were pictured smashing Japanese-made cars with sledgehammers, and in 1982 several Hitachi executives were arrested by the FBI in a high-profile sting for knowingly purchasing data stolen from IBM.[49] But the heavy duty weapons in the trade war were the policies that drove to the heart of the international monetary system. Japan had long been manipulating its currency in order to maintain a competitive edge, and the US finally used its geopolitical power to force a floating of the yen, paired with the intentional devaluation of the dollar (via the intervention of several central banks) in the 1985 Plaza Accord. The result was a rapid loss of competitiveness for Japanese manufacturing, helping to push even more investment into financial speculation and real estate and thereby accelerating the asset price bubble that would burst five years later.[50] Though the Plaza Accord marked a turning point, it was simply one pivot in a much longer-term trend of falling profitability, relocating industry and increased competition. These trends created the trade war, and the trade war created this and other policy decisions—the causality here cannot be reversed.

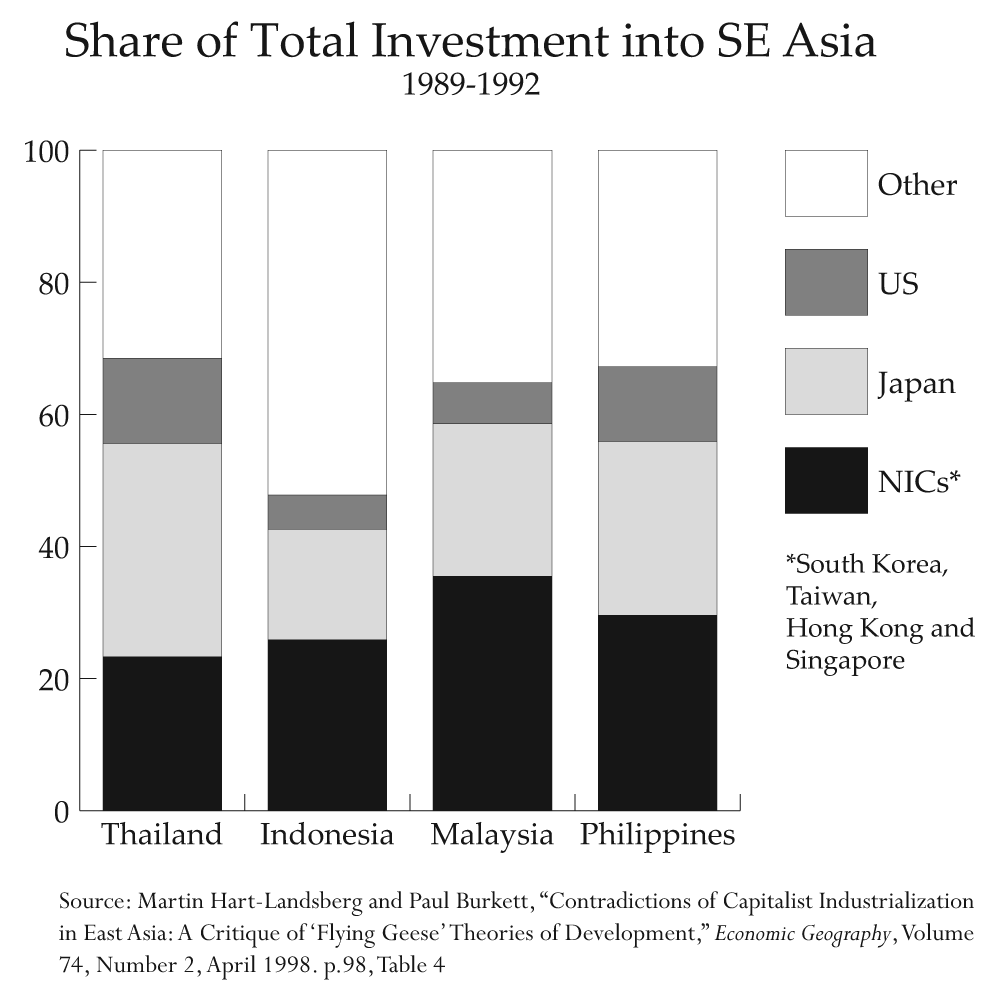

Figure 4

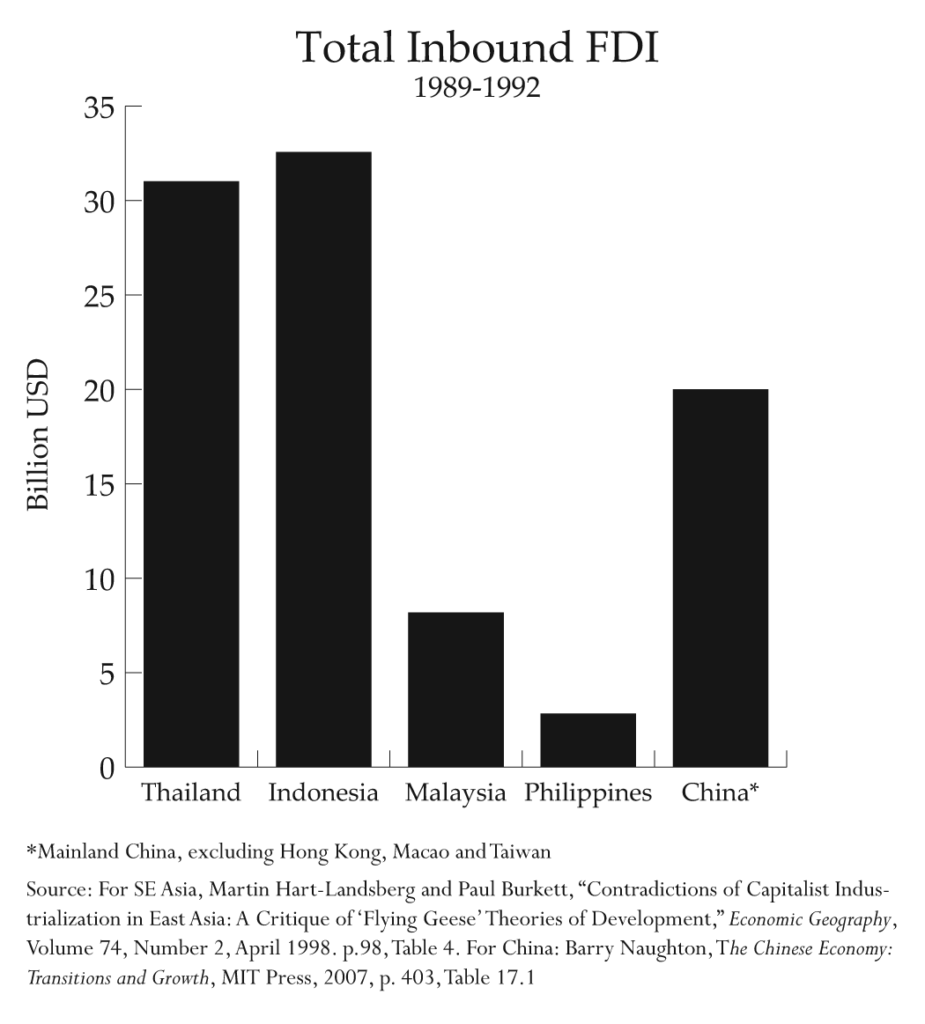

Figure 5

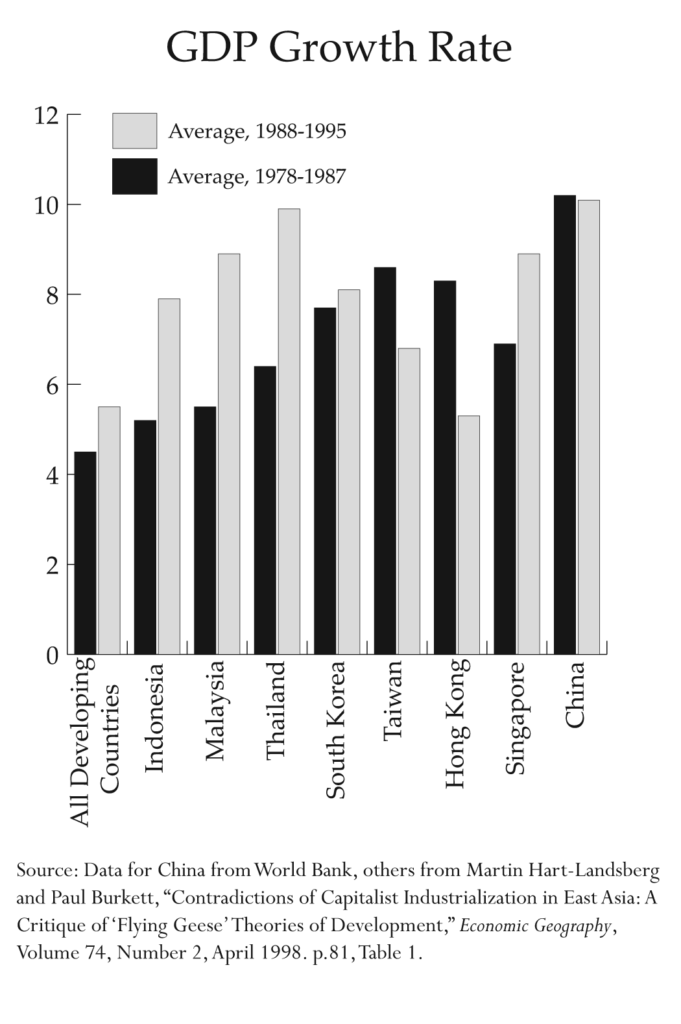

But while the Plaza Accord weakened Japanese manufacturing, it made the (dollar-pegged) currencies of many other regional economies more competitive. Decolonization and its subsequent discontents had largely passed in Southeast Asia, while the last major Indochinese war had thrown Thailand into the favor of the US. The war had also linked regional development to the Tiger economies via the subcontracting arrangements outlined above. By the time that the Plaza Accord was signed in 1985, then, the bottom rungs of production were primed for export to poorer countries peripheral to the newly constructed hubs of the Pacific Rim. A new set of “miracle” economies was predicted by IMF and World Bank economists, centered on Thailand, Malaysia and Indonesia, though sometimes including the Philippines and the Chinese mainland. Such predictions were based on a rapid increase of FDI into the region, led by investors from Japan and the Tiger economies (and, for China, particularly from Hong Kong, Taiwan and Macau).[51] The result of this was another wave of astounding GDP growth, far exceeding that of the developed economies while also surpassing even the higher average rates experienced in the world’s developing countries and quickly overtaking the growth rates of the Tiger Economies (Singapore, due to its role as a financial node in this process, was the one exception: see Figure 6).[52]

Figure 6

As previously seen in the cases of Japan, South Korea and Taiwan, much of this growth was facilitated by the patronage of the US military in the region. This is particularly true of Thailand, which provided both combat troops and a series of military bases for American use during the war in Indochina. Between 1950 and 1988, the US provided “over US$1 billion in economic and US$2 billion in military assistance,” with the bulk of this flowing into the country during the war years between 1965 and 1975.[53] The relative weight of this aid becomes clear when compared to total FDI, which was a mere $1.18 billion between 1961 and 1980, growing to $6.88 billion in 1981 to 1990 and $5.05 billion in the handful of boom years between 1988 and 1990.[54] The $3 billion of direct aid received between 1950 and 1988, spurred by military interests, compares to some $8 billion in FDI over roughly the same period. Through the bulk of American military involvement in Vietnam, total US aid roughly equaled Thailand’s entire budget of foreign reserves (from 1965-1976).[55] The relative importance of direct military patronage only decreased when Japanese FDI began to pour into the Thai economy following the Plaza Accord. While US-originated FDI had composed 45.1 percent of Thailand’s total in 1965 to 1972, compared to 28.8 percent for Japan, these figures were reversed by the early 1990s (see Figure 4 above). Between 1987 and 1995, Japanese investment composed 31.6 percent of the total, and the US share dropped to 13.2 percent.[56]

Exports from Thailand to Japan increased over the same period, following a pattern seen across Southeast Asia, where trade balances (imports minus exports) with Japan (as well as South Korea and Taiwan) were negative and tended to become more imbalanced after 1985, while positive imbalances grew with the US and European economies over the same period. These trade surpluses with the West, however, were not enough to entirely counteract the trend toward an overall trade deficit across the region, and the drying-up of the FDI that counterbalanced these deficits after the Asian financial crisis would show just how dire this imbalance was.[57] More importantly, this imbalance was itself a signal of the inequalities built into the supposedly win-win sequence of “flying geese” industrialization. In reality, both the Tiger Economies and the booming Southeast Asian countries were part of an emerging Pacific Rim hierarchy, shaped by US military interests and economically dominated by Japan, which was locked in a competitive symbiosis with the US economy. In the East Asian Tigers, this hierarchy would play out via conflicts over the sharing of intellectual property and high-tech market shares and production techniques.[58]

In Southeast Asia, the regional inequalities were much starker. Each sequence of industrial restructuring and technology transfer in the region had been accompanied by a growing reliance on imported technologies and components, as well as a decreasing reliance on import-substitution as a driver of domestic development. By the time that a major wave of restructuring hit Southeast Asia, much of the incoming FDI took the form of highly mobile firms utilizing cheap labor without transferring substantial ownership of advanced technologies to capitalists in the host countries—or doing so only very selectively. The effect was that “the new exporting industries [had] been grafted onto economies whose small manufacturing sectors are notable for their histories of rent seeking and inefficiency.”[59] In many cases, as in Indonesia, ownership was disproportionately concentrated in the hands of both foreign owners and a small fraction of local capitalists who had preferential ties to either military juntas or bamboo network businessmen.[60] This has been characterized as a somewhat “technologyless” industrialization, particularly pronounced in export sectors, which tended to be both geographically concentrated in export processing zones, dominated by foreign-controlled firms (in Malaysia, such firms contributed some 75 to 99 percent of major exports) that built very few backward-linkages to domestic enterprises.[61]

Regionally, these export industries were incorporated into triangular trade hierarchies, with Hong Kong and Singapore providing financial services, while Japan, Taiwan and Korea competed as sources of high-tech inputs, which were then processed in a production chain stretching from the Tiger economies down into Southeast Asia (and increasingly the Chinese mainland), sorted by labor costs and the capital-labor ratios of the industry in question, with raw materials provided by Southeast Asia (alongside the array of countries that composed the Global South) and the ultimate product exported to end markets in the US and Europe. Meanwhile, the entire trade infrastructure of the Pacific Rim region was dependent on the production of containers, ships and port infrastructure, which composed a new geographical hierarchy of logistics hubs dominated by export-processing zones and gargantuan container ports. It was within this context that the opening of mainland China was made possible. The mainland’s ascent, in competition with Indonesia, Thailand and Malaysia, was thus dependent on the flourishing of the bamboo network after the bursting of the Japanese bubble in 1990, and finally secured by the collapse of its regional competitors in the Asian Financial Crisis of 1998.

Continue to Part 4>>

Notes

[1] Naughton 2007, pp.377-380

[2] Elspeth Thomson, “Japanese FDI, Exports and Technology Transfer to China,” Centre for Asian Pacific Studies Working Paper Series, Number 50, 1997. pp.1-4, Tables 1-2

[3] Naughton 2007, Figure 16.1

[4] Ibid, pp.380-381

[5] Naughton 1996, p.69

[6] Ibid, pp.71-73, Figure 2.

[7] Ibid, p.71

[8] Naughton 2007, p.383

[9] Ibid, p.382

[10] Ibid, p.386

[11] Ibid, p.393

[12] Thomson 1997, p.3

[13] Naughton 2007, p.382

[14] George C.S. Lin, Red Capitalism in South China: Growth and Development of the Pearl River Delta, UBC Press 1997, pp.172-174

[15] In each instance Hong Kong was overtaken by Singapore, which played a similar role for both Southeast Asia and mainland China throughout this period. In more recent years, mainland ports have dominated the rankings, with 7 of the 10 busiest container ports in the world in 2017 located in the mainland. For the details on Singapore overtaking Hong Kong, see: “Hong Kong hands port crown to Singapore,” Asia Times, 2005, archived here: <https://www.container-transportation.com/singapore-becomes-largest-container-port.html>

[16] Graeme Lang, Catherine Chiu and Mary Pang, “Impact of Plan Relocation to China on Manufacturing Workers in Hong Kong,” in, Pui-tak Lee, Ed., Hong Kong Reintegrating with China: Political, Cultural and Social Dimensions, Hong Kong University Press, 2001. p.110

[17] Ibid

[18] Graham E. Johnson, “Degrees of Dependency, Degrees of Interdependency: Hong Kong’s Changing Links to the Mainland and the World,” in Pui-tak Lee, Ed., Hong Kong Reintegrating with China: Political, Cultural and Social Dimensions, Hong Kong University Press, 2001. p.86

[19] George C.S. Lin, Red Capitalism in South China: Growth and Development of the Pearl River Delta, UBC Press, 1997. pp.63-65

[20] For the size and growth trends of the PRD, see: “East Asia’s Changing Urban Landscape: Measuring a Decade of Spatial Growth. Urban Development,” The World Bank, 2015. <https://openknowledge.worldbank.org/handle/10986/21159>

[21] This was a notable change for what had once been one of the most industrialized regions in China (alongside Shanghai), and a key site in the first, stalled transition. The PRD was, in fact, where the modern workers movement started, with China’s first two labor unions founded by anarchists in Guangzhou the 1910s, and important strikes occurring until the movement was crushed in the white terror of 1927. Seasonal waged labor had been common, and even smaller cities in the orbit of Guangzhou such as Foshan had become industrialized and linked to global trade. The region was effectively deindustrialized under the developmental regime.

[22] Lin 1997, pp.63-65

[23] ibid, p.66

[24] ibid, p.81, Table 5.1

[25] Ching Kwan Lee, Against the Law: Labor Protests in China’s Rustbelt and Sunbelt, University of California Press, 2007. p.161

[26] The Chinese administrative definition of “city” (shi市) is not entirely commensurate with the English connotation of the word, nor does it match the Western administrative category. Though the Chinese shi will often refer to what we’d think of as a city, it is also commonly used to signify a “prefecture-level city” (地级市), which includes a central city area, its connected suburbs and a substantial portion of surrounding rural land. Nonetheless, since the PRD as a whole is now considered to be a coherent megacity (as measured by the World Bank), Shenzhen alone is certainly built-up enough to be characterized as a city in the common sense of the word, despite the persistence of some swaths of agricultural production and less developed green space within its administrative boundaries. For data on Shenzhen’s growth, see: Wendell Cox, “The Evolving Urban Form: Shenzhen,” New Geography, 25 May 2012. <http://www.newgeography.com/content/002862-the-evolving-urban-form-shenzhen>

[27] Lin 1997, pp.85 and 104, Table 5.10

[28] Ibid, pp.96-99

[29] Ibid, p.100, Table 5.8

[30] Ibid, pp.90-91, Table 5.6 and Map 5.2

[31] Ibid, pp.110-111, Tables 5.11 and 5.12

[32] Ibid, p.71

[33] Ibid, p.114 Table 5.14

[34] ibid

[35] Johnson 2001, pp.84-86

[36] There are a number of works documenting this network, which is defined in a variety of ways. The information below is drawn from a range of these works, including the sources cited throughout and several more general overviews: Murray Weidenbaum and Samuel Hughes, The Bamboo Network: How Expatriate Chinese Entrepreneurs are Creating a New Economic Superpower in Asia, Free Press, 1996; Brian C. Folk and K.S. Jomo, Ethnic Business: Chinese Capitalism in Southeast Asia, First Edition, Routledge, 2003; Cheung, Gordon C. K. Cheung and Edmund Terence Gomez, “Hong Kong’s Diaspora, Networks, and Family Business in the United Kingdom: A History of the Chinese ‘Food Chain’ and the Case of W. Wing Yip Group,” China Review, Chinese University Press, Volume 12, Number 1, Spring 2012. pp. 45-72.

[37] Zhuang Guotu, “Trends of Overseas Chinese Business Network in East Asia: As Mirrored from Overseas Chinese Investment in Mainland China since 1978,” Institute of International Relations and Area Studies, Ritsumeikan University, Volume 4, 2006. pp.1-23

[38] Zhuang 2006, p.5

[39] Another large migration would begin in 1984, this time out of Hong Kong entirely, spurred by the decision to transfer the colony from British control to the mainland. The effects of this migration were most visible in places like Vancouver, BC, where the influx of Cantonese capital completely reshaped the city. The ultimate effect has simply been an even greater integration of Pacific Rim capital networks, with these new settlements in Canada facilitating much more recent mainland interests in Canadian natural resources, to take one example.

[40] Lin Jinzhi, Jin Dai Huaqiao Tuozi Guonei Qiye Gailun (General view of Overseas Chinese invested enterprises in China in the modern period), Xiamen University Press, p. 53.

[41] Zhuang 2006, p.9

[42] Richard Robinson, Indonesia: The Rise of Capital, Equinox Publishing, 1986. p.273

[43] Ibid, pp.276-277

[44] Figures qtd. in Zhuang 2006, p.10

[45] Itoh 1990, p.226, Table 10.2

[46] Bernard and Ravenhill 1995, p.181

[47] Itoh 1990, p.220

[48] Ibid, p.226

[49] See: Peter Tasker, “Trade wars – lessons from the 1980s,” Nikkei Asian Review, March 30, 2018. <https://asia.nikkei.com/Opinion/Trade-wars-lessons-from-the-1980s2>; and Michael S. Malone, “Hitachi-FBI Tapes are Released,” New York Times Archives, May 16, 1983. <https://www.nytimes.com/1983/05/16/business/hitachi-fbi-tapes-are-released.html>

[50] John Hemmings, “Lessons from the America-Japan Trade War of the 1980s,” National Interest, July 2, 2018. <https://nationalinterest.org/feature/lessons-america-japan-trade-war-1980s-24882>

[51] Hart-Landsberg and Burkett 1998, p.98, Table 4 and Naughton 2007, p.403, Figure 17.1

[52] Hart-Landsberg and Burkett 1998, p.89, Table 1

[53] Jim Glassman, Thailand at the Margins: Internationalization of the State and the Transformation of Labour, Oxford University Press, 2004. p.37

[54] Hart-Landsberg and Burket 1998, p.90, Table 2

[55] Glassman 2004, p.37

[56] Ibid, p.93

[57] Hart-Landsberg and Burket 1998, p.105, Table 5

[58] Ibid, pp.98-101

[59] Bernard and Ravenhill 1995, p.196

[60] See Robinson 1986.

[61] Bernard and Ravenhill 1995, pp.195-197, Hart-Landsberg and Burket 1998, pp101-107